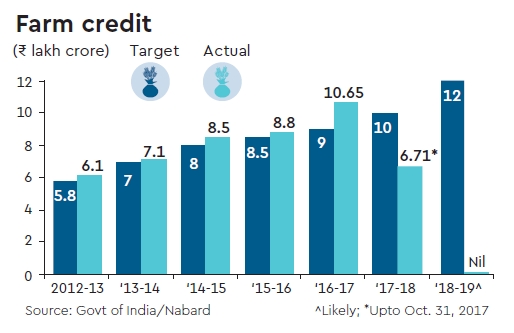

Finance minister Arun Jaitley may announce agricultural credit target of Rs 12 lakh crore for 2018-19, up 20% from the level for the current year, as he lends focus to addressing rural distress in the coming Budget. While the farm credit targets have been overachieved in recent years, the disbursal by October end this fiscal was 67% of the annual plan. The government is confident of exceeding the farm credit target by end of March.“There may be an increase of 20% in the target as this is the last full Budget before the (government’s) tenure ends in May 2019. The UPA-II government had also raised the target by 20% in its last year in office,” an official said. Jaitley had asked banks and cooperatives to lend Rs 10 lakh crore in FY18 as farm loan. Farm loans of Rs 6.71 lakh crore have already been disbursed as on October 31, 2017, official data show.

“The short-term credit may help address the immediate concerns of the farmers, but it is equally important to earmark a good amount for long-term credit to bring in investment in agriculture,” said Shashanka Bhide, director of Madras Institute of Development Studies. The government provides a 2% interest subsidy to small farmers availing loans of up to Rs 3 lakh from banks. Further, farmers who repay their loans within a year are provided an additional interest subsidy of 3%, making the effective cost of the loan to farmers 4%. About 75% of farmers avail the additional subsidy by paying in time, an official said. Outstanding bank credit to agriculture and allied sectors touched Rs 9.88 lakh crore as of November 24, 2017, compared with Rs 9.11 lakh crore a year earlier, showed the RBI data.

The agriculture ministry has been insisting on increasing the lending to the farm sector so as to bring more and more farmers under the ambit of institutional credit and save them usurious interest charged by money lenders, a top official said. This will also help increase the spending in the rural areas. About 60% of the outstanding farm loans were taken from institutional sources (bank, cooperative society and government) and another 26% from money lenders, NSSO data showed. Institutional sources include 2.1% by the government, 14.8% by cooperative societies and 42.9% by banks. Out of an estimated 90.2 million agricultural households in rural India, about 52% have reported outstanding loans in 2013, according to the NSSO survey.