April 2, 2020

Recent disruptions to global economic activity due to COVID-19 reemphasize the importance of trade to the U.S. pork industry. Trade in pork products has grown as the U.S. has turned into a pork export powerhouse. Importantly, the relative importance of U.S. pork’s customers has changed dramatically in recent years, suggesting future growth could lie outside traditional destinations. Growth in pork trade means economic conditions in importing countries are important to the U.S. pork industry.

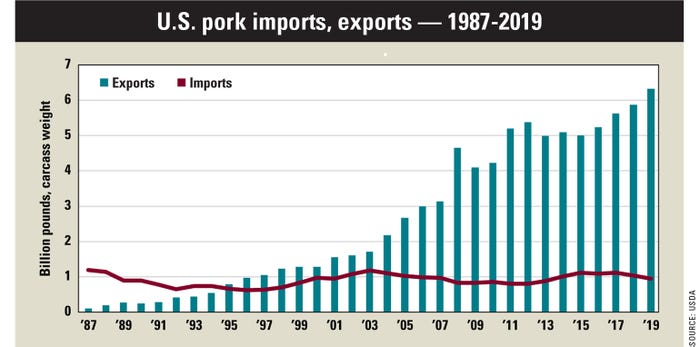

As recently as the mid-1980s, the U.S. exported less than 1% of its pork production each year. The U.S. was also importing some pork products, equivalent to 6% to 8% of U.S. pork production. The imports augmented the U.S. pork supply, primarily in a small number of products. World pork trade started to change in the late 1980s, and the pace of change accelerated in the 1990s and 2000s.

By 1995, U.S. pork exports measured in carcass weight exceeded pork imports, turning the U.S. into a net pork exporter. U.S. exports of pork continued to grow throughout the ’90s and into the 2000s. During the most recent five years, U.S. pork exports averaged the equivalent of about 22% of U.S. pork production. Stated another way, the U.S. was exporting the equivalent of just over 1 out of every 5 hogs in recent years.

While U.S. pork exports grew, pork imports stagnated. In recent years, imports of pork averaged the equivalent of just 4% of U.S. production. Over the past three-plus decades, the U.S. became a large net exporter of pork. Net exports, which are exports minus imports, were the equivalent of just over 19% in 2019 and increased steadily over the past five years.

Where U.S. pork goes

The destinations for U.S. pork exports have changed. During the ’80s and ’90s, U.S. pork exports were driven primarily by Japan. Thirty years ago, Japan was the destination for 55% of U.S. pork exports. Ten years ago, the country absorbed 31% of U.S. pork exports, but in 2019, just 18% of exports were shipped to the Japanese market.

At the same time, Canada and Mexico have become bigger trading partners. For example, in 2019, 25% of U.S. pork exports went to Mexico and 9% were shipped to Canada. Although both countries were important destinations three decades ago, growth in shipments to these two destinations grew rapidly as the total U.S. pork export market grew.

Compared to 1994, when the North American Free Trade Agreement was implemented, pork exports to Mexico and Canada increased tenfold. In contrast, exports to Japan over this same time frame increased fivefold.

What about China? In 2019, mainland China was the destination for 16% of U.S. pork exports. That trade volume was boosted sharply by the country’s problems with African swine fever. U.S. shipments to China tripled in 2019 compared to 2018. In contrast to 2019, mainland China took in just 6% of U.S. pork exports in 2018.

Depending on the status of trade negotiations with China, future growth in pork exports to China could be a bright spot for the U.S. pork industry.

Mintert is a Purdue University Extension agricultural economist and director of the Purdue Center for Commercial Agriculture. He writes from West Lafayette, Ind.

About the Author(s)

You May Also Like