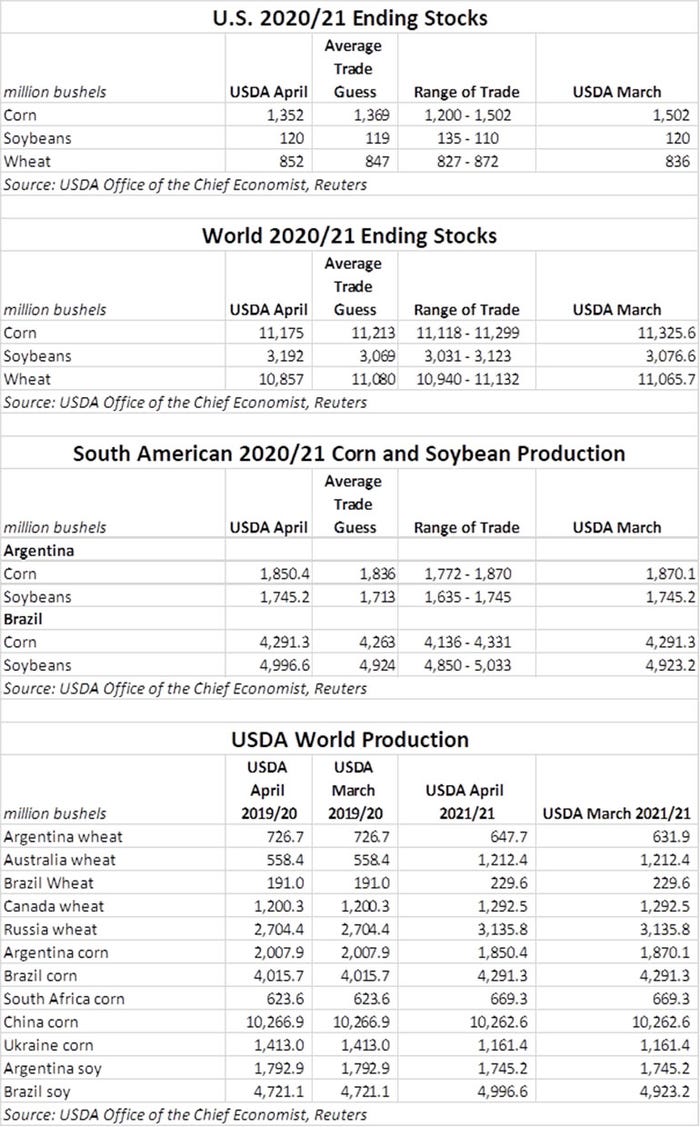

Analysts were expecting USDA to finally show reduced U.S. corn stocks in its April World Agricultural Supply and Demand Estimates (WASDE) report, out Friday morning, after stubbornly holding them steady a month ago. The agency noted a moderate downward shift today, pushing them down 150 million bushels to 1.352 billion bushels.

That news kept corn prices in the green, with gains of around 1% immediately following the report. Soybean stocks held steady at 120 million bushels, meantime, with wheat moving a bit higher to 852 million bushels. Both numbers were mostly in line with analyst expectations.

Corn takes center stage

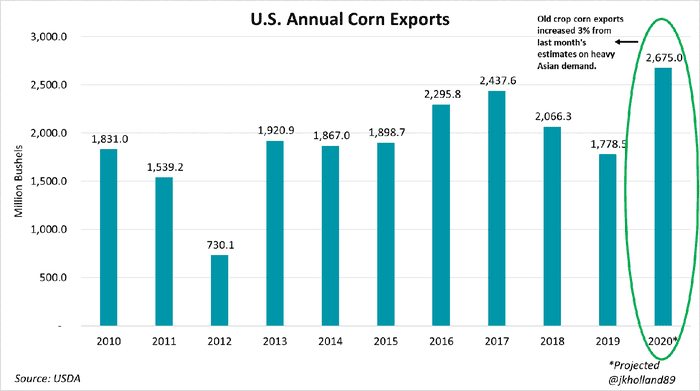

Eye-popping export volumes over the past month did not go unnoticed by USDA. U.S. corn exports were raised 75 million bushels to 2.675 billion bushels – a new record high – in today’s report to reflect surging livestock demand from Southeast Asian countries, led primarily by China.

Marketing year-to-date corn shipments to the next five largest U.S. buyers after China (Mexico, Japan, Columbia, South Korea, and Taiwan) are up nearly 25% from the same period in 2019/20. Southeast Asian countries are driving the largest increases, especially South Korea (290% increase), Japan (31%), and Taiwan (188%).

A year after the ethanol industry collapsed amid pandemic-driven lockdowns, new signs of recovery indicate the sector is ready to return to pre-pandemic output levels. As Total Farm Marketing’s Naomi Blohm points out in a recent Ag Marketing IQ column, “Corn used in last week’s production was estimated to be near 98.5 million bushels, ahead of the 96 million bushels needed each week to keep corn use for ethanol in line with the USDA projection of 4.95 billion bushels.”

Plus, a pair of Heartland-based ADM ethanol plants idled at the height of the pandemic are likely to restart production in the next week. USDA confirmed a bullish recovery, raising 2020/21 corn usage rates for ethanol 25 million bushels to 4.975 billion bushels.

The extra demand from end users could work in Midwestern farmers’ favor this year. For farmers still determining last-minute crop rotations, the added demand increases the value of price offerings processors are willing to pay to source corn. An ethanol recovery could sway some acres away from soybeans in areas of the Corn Belt close to these plants.

USDA also increased corn’s feed and residual usage estimate by 50 million bushels to 5.7 billion bushels for 2020/21. But this revision is not exactly straight forward. USDA-NASS found an extra 27 million bushels of corn had been used between September 1, 2020 and December 1, 2020 in last week’s Quarterly Grain Stocks report.

Part of today’s 50-million-bushel addition is accounted for by that 27-million-bushel Quarterly Stocks revision, but it also includes an uptick for livestock consumption. Pasture conditions in the U.S. West and Plains, where over 40% of U.S. cattle production is sourced, continue to decline amid drought conditions in the region, forcing farmers to shell out money for high-priced corn in their rations. Meat demand continues to rise, especially with grilling season on the horizon, so expect livestock producers to remain more reliant on purchasing feed for the short run.

Soybean, wheat stocks little changed

USDA largely left U.S. soybean stocks unchanged in today’s report, though some balance sheet adjustments were made to reflect revisions to December 1, 2020 soybean stocks and extra Chinese export demand during Brazil’s shipping delays.

Some of the first signs of demand rationing were suggested after USDA shaved 10 million bushels from 2020/21 crushing estimates. The current marketing year’s crush volume remains at a record high of 2.19 billion bushels. But tightening margins for livestock and poultry feeders, as well as lingering uncertainty in the supply chain amid the pandemic recovery, could reduce feed demand going forward. The push for biodiesel remains hot, though dwindling stocks could limit the sector’s short-term growth.

USDA reduced both import projections and feed and residual targets for U.S. wheat in today’s report, widening wheat stocks by 15 million bushels to 851 million bushels. The feed and residual adjustment is largely a function of December 1, 2020 quarterly grain stocks revisions, which were made after off-farm and commercial storage facilities submitted late reports to NASS.

South American supply adjustments

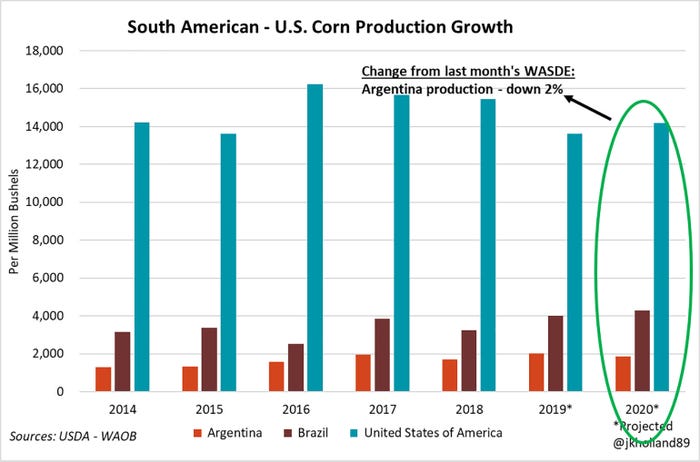

USDA cut 20 million bushels from 2020/21 Argentine corn production to 1.850 billion bushels as drought continues to degrade crop conditions due to La Niña weather patterns. The smaller production estimate from the world’s third largest corn exporter, rising global feed demand, and cuts to U.S. stocks sent global stocks 150 million bushels lower to 11.175 billion bushels.

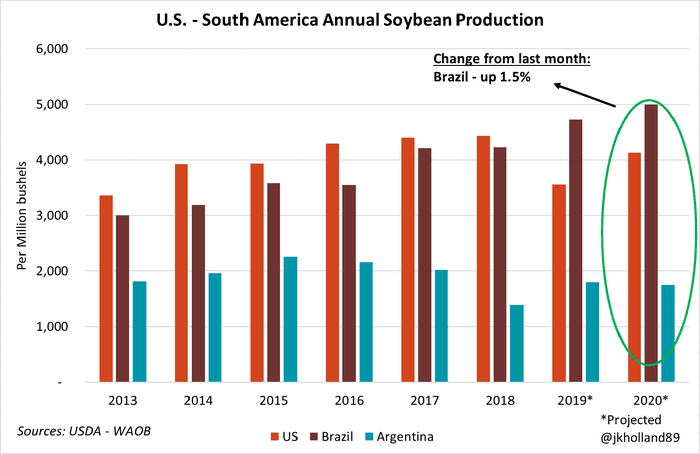

Favorable crop conditions in Brazil’s Trio Grande do Sul and better than anticipated harvest data from Mato Grosso led USDA to raise its estimates on Brazil’s 2020/21 soybean crop by 74 million bushels to 4.997 billion bushels – a new record high for Brazilian soybean production.

Brazil’s export forecast also rose 37 million bushels to 3.160 billion bushels for the 2020/21 shipping season, which is likely to ease pressure on U.S. supplies later this summer. Old crop soybean futures traded $0.05-$0.08/bushel lower at last glance on the news.

Livestock demand drives global grain flows

Chinese soy crush estimates were also cut by USDA to the tune of 73 million bushels. The new 2020/21 Chinese crush volume of 3.527 billion bushels reflects ongoing availability issues with Brazilian soybean exports, which were delayed after excessive rains slowed harvest paces. High soy prices and scarce supplies have led many Chinese crush facilities to idle until the Brazilian crop arrives on Chinese shores.

The delays could favor the recovering Chinese hog herd, which has been suffering from outbreaks of African swine fever (ASF) and other winter diseases due in large part to faulty vaccines. The herd was expected to return to pre-ASF volumes by June of this year. But the resurgent virus is likely to dampen recovery paces, which could ease pressure on Chinese soy processors especially as wheat is increasingly added to rations.

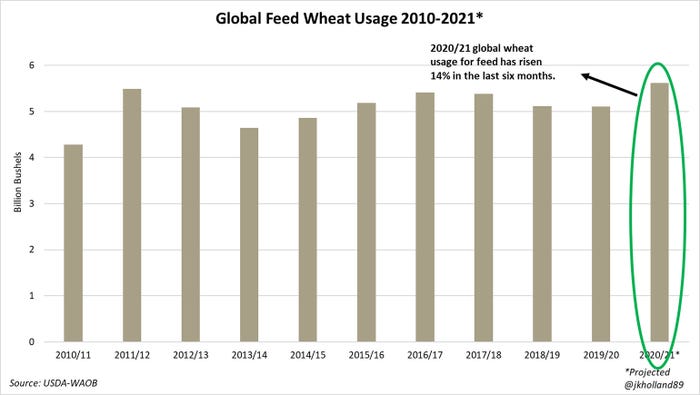

Wheat prices saw another bullish run after USDA released updated data. Going into the report, the expectation of high new crop supplies largely capped pre-report gains, especially as forecasts favor bumper winter wheat crops in the European Union, Ukraine, and Russia this summer.

But a 135-million-bushel increase to global feed consumption, coupled with a 53-million-bushel increase in global food usage, sent global 2020/21 wheat stocks down 208 million bushels to 10.857 billion bushels. Supplies are likely to remain adequate through the 2021/22 shipping season despite the tightened beginning stocks estimate.

Increased Chinese demand for wheat, which is a cheaper feed alternative for livestock producers, also paved the way for futures price gains for the wheat complex this morning. China’s 2020/21 ending wheat stocks are expected to fall for the first time since 2012/13 on increased 2020/21 feed demand, which USDA grew by 184 million bushels in today’s report to 1.470 billion bushels.

In the short run, the U.S. will likely be a primary global source for wheat, especially as Chinese demand soars and Russia’s steep wheat export tax limits international grain flows.

Price analysis

USDA also updated season average prices for domestic 2020/21 crop estimates. Adjustments ranged from no changes to slightly higher. Based on the aforementioned supply and demand adjustments, here is a quick update on the most recent price projections for each commodity to provide farmers a better idea of how the current marketing year will influence 2020/21 crop rotations and profit margins.

All-wheat price: unchanged at $5.00/bushel

Corn: unchanged at $4.30/bushel

Sorghum: up $0.05 to $5.05/bushel

Barley: unchanged at $4.70/bushel

Oats: up $0.05 to $2.75/bushel

All-rice price: up $0.10 to $13.70/cwt

Soybeans: up $0.10 to $11.25/bushel

Soybean oil: up $0.05 to $0.45/lb

Soymeal: unchanged at $400/ton

About the Author(s)

You May Also Like