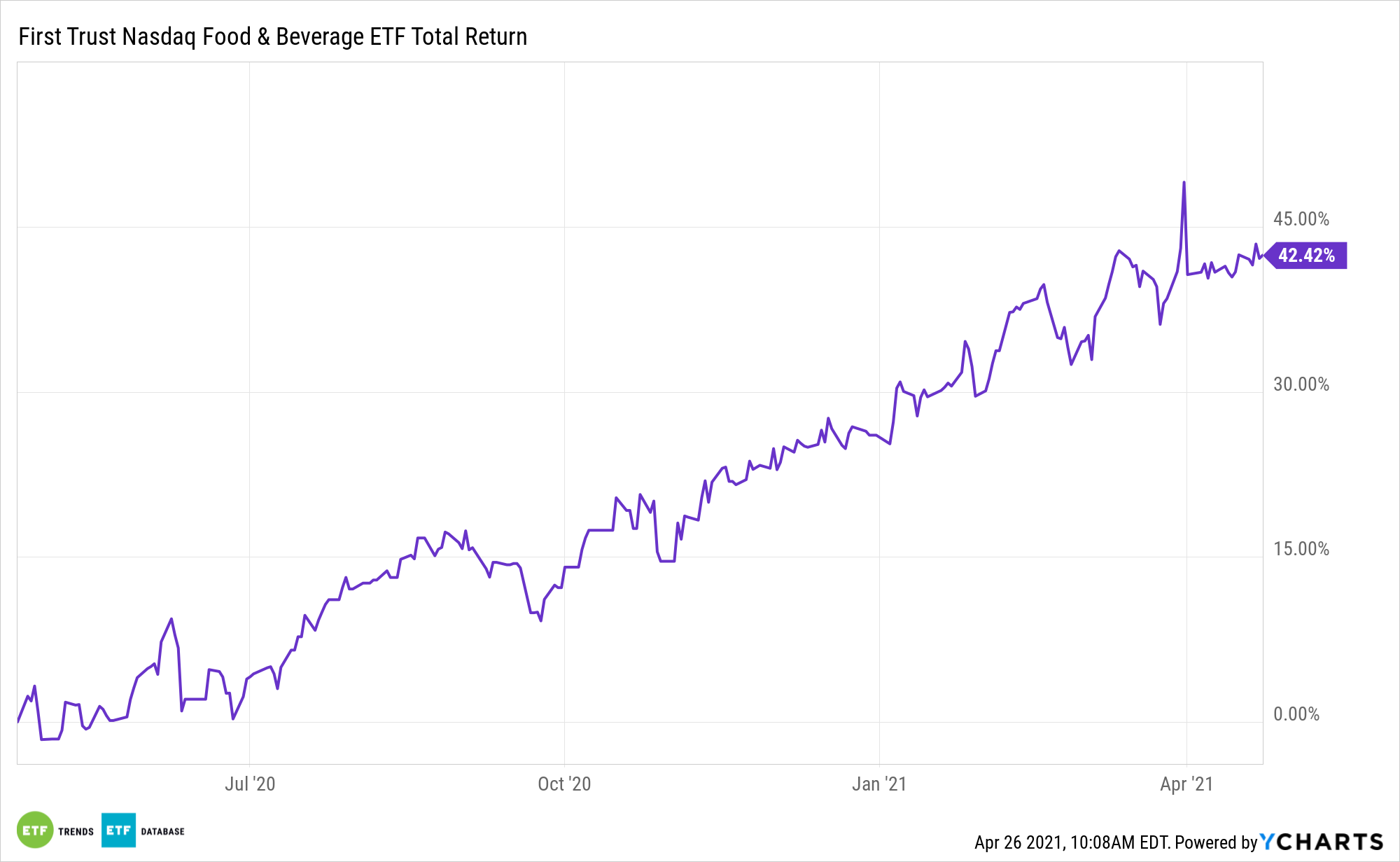

Cyclical stocks are getting all the attention these days, and growth names seemingly always captivate, but investors shouldn’t skirt defensive fare like consumer staples. The First Trust Nasdaq Food & Beverage ETF (FTXG) is an excellent starting point.

FTXG tracks “the Nasdaq US Smart Food & Beverage Index. The Fund seeks to replicate the holdings and weightings of the Nasdaq US Smart Food & Beverage Index as to generate performance results 95% correlated to that of the Nasdaq US Smart Food & Beverage Index,” according to First Trust.

What makes FTXG an interesting idea today is some market observers’ views that packaged food stocks are poised to deliver significant upside.

“More and more people are heading back to the office, to schools, and to restaurants—and eating outside their homes. Yet the pandemic-driven demand for packaged foods could stick around longer than many on Wall Street expect,” reports Andrew Bary for Barron’s.

An Appetizing Opportunity?

FTXG offers a one-two punch of steady, impressive dividends without forcing investors to pay up for those rewards – benefits that are particularly clear with packaged food stocks.

“That presents an appetizing opportunity for investors. Many food stocks offer secure dividend yields of about 3% and relatively lean valuations of about 16 times projected 2021 earnings, compared with the S&P 500 index at 22 times,” according to Barron’s.

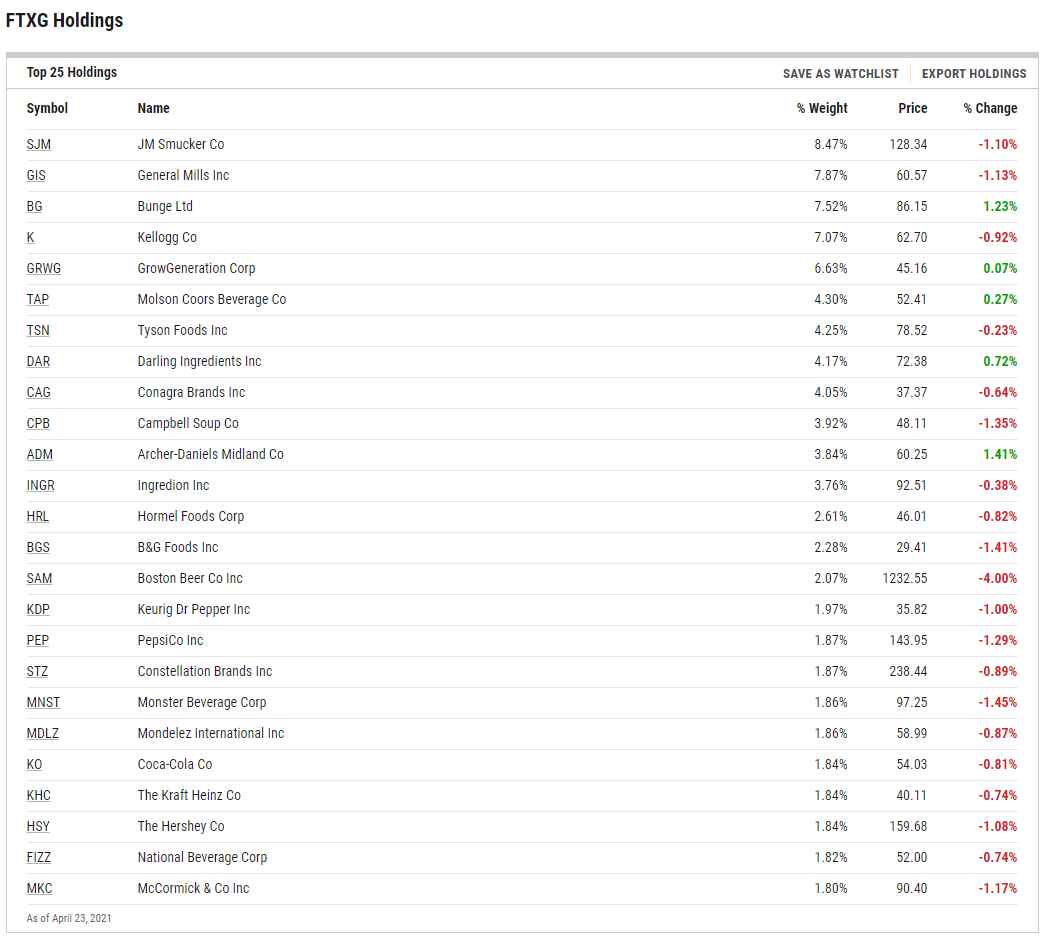

That plays into the FTXG thesis because value, as defined by cash flow to price, is one of its three scoring metrics. The other two are volatility and growth, which is defined by 3-, 6-, 9-, and 12-month average price appreciation.

“Hershey (ticker: HSY), Mondelez International (MDLZ), Conagra Brands (CAG), J.M. Smucker (SJM), Hostess Brands (TWNK), Kraft Heinz (KHC), General Mills (GIS), Kellogg (K), and Campbell Soup (CPB) are the leading food stocks. The sector badly trailed the S&P 500 in the past year as investors shifted to reopening plays from stay-at-home stocks,” according to Barron’s.

Smucker and General Mills combine for over 16% of FTXG’s roster. Kellogg and Conagra combine for more than 11%. FTXG has 30 total holdings.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.