A friend recently sent me a Bloomberg article about China’s efforts to diversify agricultural imports. The idea is to lessen its reliance on the United States in anticipation of trade friction under the Trump administration.

Central and South Americans seem to be on the way to becoming the major winners. They have a surplus of agricultural products that China imports, such as grains, oilseeds, red meat, wine and nuts.

The chart below clearly illustrates what is happening with China’s agricultural imports. The African continent has not benefited much.

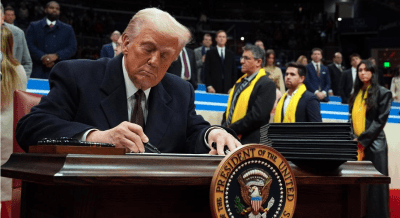

I have recently discussed the effects of Donald Trump’s trade policy in 2018, during his previous term as president, and how China retaliated against his administration’s tariffs. The Chinese switched to imports from Brazil and Argentina, hurting the US soybean, maize and pork farmers.

What we can expect in the coming months will depend on whether Trump proceeds with the higher tariffs on China, as he promised in his recent speeches.

What is clear now is that South America, as it was in 2018, may be among the winners as China searches for new sources of agricultural products.

South Africa’s standing

But South Africa should also position itself among the key suppliers of agricultural products to China in addition to its current export activity.

I sometimes doubt whether South Africans appreciate enough how big China is in global agricultural trade; it is a dominant player in the export and import of agricultural products.

In 2023, China was a leading agricultural importer, accounting for 11% of global agricultural imports, which totalled more than $200 billion, as the chart above shows. The US, Germany, the Netherlands, the United Kindgom, France, and Japan trailed behind China.

Similarly, China played a notable role in exports. In 2023, it was the fifth largest agricultural exporter in the world. The leading countries ahead of China were the US, Brazil, the Netherlands and Germany.

Few African countries benefit from these imports because of low agricultural productivity in Africa; most don’t have the volumes to export.

The leading suppliers of agricultural products to China are Brazil, the US, Thailand, Australia, New Zealand, Indonesia, Canada, Vietnam, France, Russia, Argentina, Chile, Ukraine, the Netherlands and Malaysia.

The only African country in China’s top 30 agricultural suppliers is South Africa, which ranked 28th in 2023. Still, South Africa remains a negligible player in the Chinese agricultural market, accounting for a mere 0.4% ($979 million) of China’s agricultural imports of $218 billion in 2023.

Sudan and Zimbabwe are other African agricultural suppliers to China, ranking 33rd and 34th, respectively.

Given this reality and China’s efforts to diversify its agricultural suppliers, it is key that the South African message in engagements with the Chinese authorities should be more firm and persuasive in promoting agricultural exports.

South Africa has an agricultural surplus each year, exporting about half of its yearly production. In 2023, South Africa’s agricultural exports amounted to a record $13.2 billion. This is nowhere close to the amount of money China spends annually importing agricultural products from the world — a staggering $218 billion.

China is already one of South Africa’s major agricultural markets for a variety of fruits, wine, red meat, nuts, maize, soybeans and wool. But there is room for more ambitious agricultural export efforts.

The South African agricultural sector — organised agriculture and researchers — consistently points out the need to lower import tariffs in China and remove phytosanitary constraints on various products. From now on, this should be a topic of conversation between Chinese and South African authorities.

Wandile Sihlobo is an agricultural economist.

Increase agricultural exports South Africa! Trump has handed you a golden opportunity!