PHOTO

Abu Dhabi National Energy Company (TAQA) is a diversified utilities and energy group headquartered in Abu Dhabi. Image courtesy TAQA.

Abu Dhabi National Energy Company PJSC, or TAQA, is an integrated utilities firm headquartered in the UAE capital and with operations across 25 countries covering Europe, the Middle East, and Africa.

TAQA has invested in power and water generation, water treatment and reuse, transmission and distribution assets, in addition to upstream and midstream oil and gas operations. Its assets are in the UAE, Canada, Ghana, India, Morocco, Oman, the Netherlands, Saudi Arabia, the United Kingdom, and the United States.

It also holds exclusive rights to transmission and distribution (T&D) ventures in Abu Dhabi, maintaining a minimum 40% stake in all Emirates Water and Electricity Company (EWEC) generation projects until 2030.

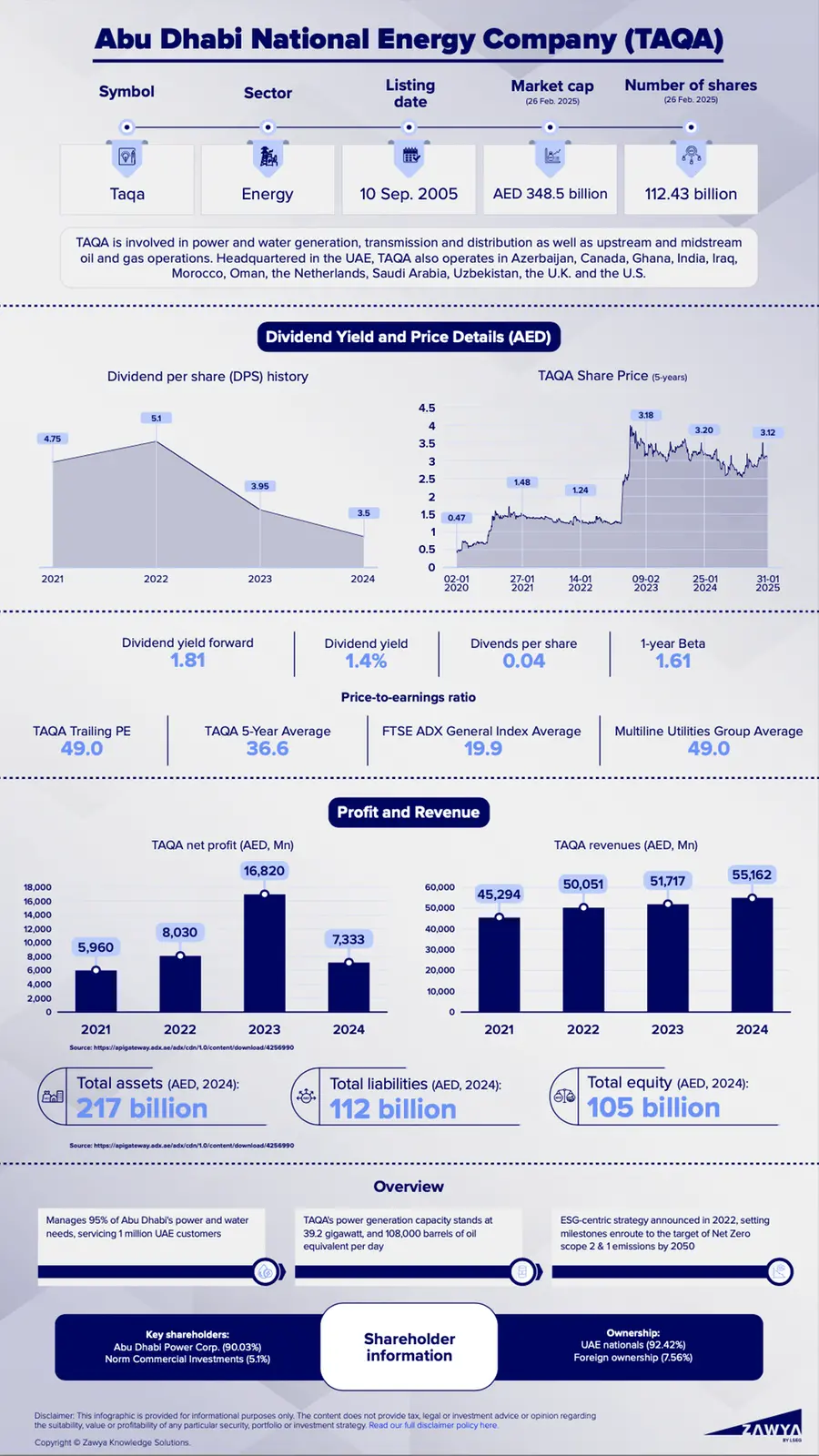

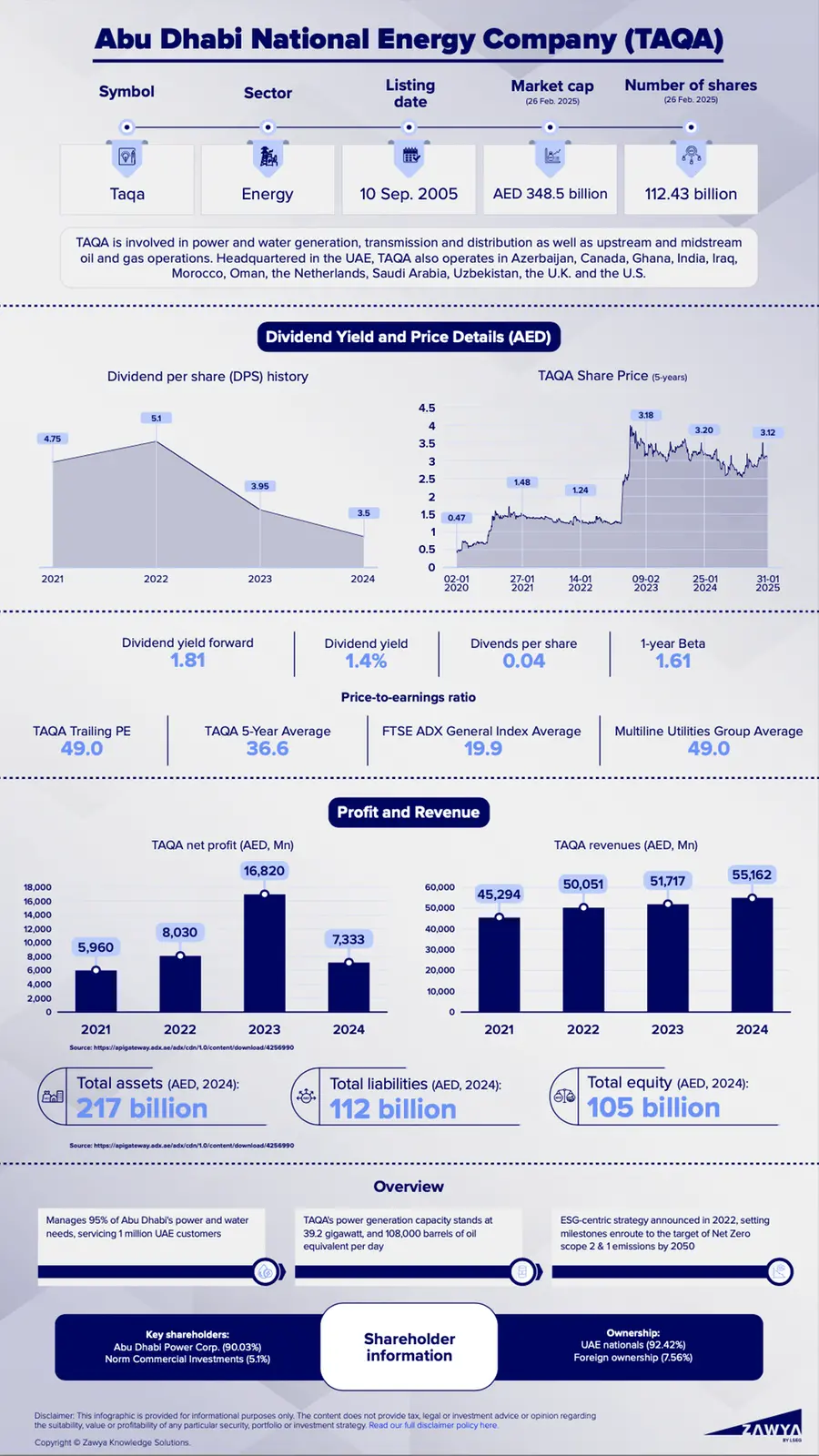

Click here to download infographic

Strategic Growth Drivers

TAQA has revised its growth targets following the successful integration of Abu Dhabi-based Masdar’s renewable energy business.

In 2022, TAQA oversaw Masdar’s renewable business with a 43% shareholding, with Mubadala retaining 33%, and ADNOC holding 24%. Masdar operates in more than 40 countries and has developed and invested in projects with a combined value of over USD 20 billion. The partnership sets out to position Masdar as a global clean energy powerhouse, consolidating the renewable energy and green hydrogen efforts of TAQA, Mubadala, and ADNOC under a refreshed single Masdar brand. TAQA paid USD 1.02 billion in cash for its stake.

To expand its overall operations, TAQA has outlined plans to deploy AED 75 billion in capital expenditure and investments by 2030 to achieve its announced targets. This includes expanding power and water capacity, as well as the previously committed AED 40 billion allocated for regulated T&D assets between 2021 and 2030. More than 80% of this total investment will be directed toward energy transition activities, with AED 50 billion qualifying for sustainable finance under the European Union (EU) taxonomy.

TAQA continues to expand its T&D business beyond the UAE through both organic growth and acquisitions. In addition, the company is establishing new growth targets for water generation capacity, aiming for two-thirds of its total water generation to rely on highly efficient reverse osmosis (RO) technology by 2030.

In its oil and gas operations, TAQA is sustaining production capacity in Canada while gradually decommissioning certain assets in the North Sea. The company also upholds its commitment to maintaining a standalone investment-grade credit rating.

TAQA's strategic acquisitions, focus on renewable energy, and robust fiscal management have allowed it to build value for its stakeholders.

Investment Analysis

As one of the largest publicly listed integrated utility companies in the Middle East, TAQA boasts total assets of AED 217 billion.

It has increased capital expenditure by 63.8% to AED 9.2 billion with visible construction progress in key projects such as the Mirfa 2 Reverse Osmosis and the Shuweihat 4 Reverse Osmosis.

The company also got a creditworthiness boost when Fitch Ratings upgraded its long-term default rating and senior unsecured rating to AA from AA-, with a stable outlook in 2024. The ratings agency cited strong government support and the company’s “pivotal role in developing highly strategic projects,” as key reasons for the upgrade.

The utility company has also been bolstered by a long-standing and transparent regulatory framework governing its T&D business in Abu Dhabi. Additionally, it is fully aligned with the capital’s 2030 Economic Vision, while also supporting the UAE’s Net Zero by 2050 initiative by actively contributing to the goal of increasing the country’s clean energy generation to 50% by 2050.

Share Growth Potential

TAQA’s share has surged 353% over the past five years. The company scores a 4 on its fundamentals, suggesting a neutral outlook, and a rating similar to the wider multiline utilities group tracked by LSEG Data and Analytics. The firm disbursed a fixed dividend per share worth 3.95 fils in 2023. TAQA’s board of directors approved an interim dividend per share worth 2.1 fils for the first nine months of 2024. Final and variable dividends remain subject to approval.

Relative Valuation

- TAQA currently has a risk rating of 2, which is significantly below the FTSE ADX General Index average rating of 5.

- It currently has a Relative Valuation Rating of 1, below the FTSE ADX General Index average rating of 5.9.

- TAQA's trailing price-earnings (P/E) ratio is significantly above its five-year average.

- TAQA’s price to sales ratio of 6.3 represents a 12.5% premium to its five-year average of 5.6.

- Based on trailing P/E, TAQA represents a 33.8% premium to its five-year average of 36.6.

Fiscal position

TAQA maintains a solid fiscal stance, evidenced by its financial metrics in FY 2024. The company's earnings before interest, taxation, depreciation, and amortisation (EBITDA) reached AED 21.4 billion, up by 5.9% compared to the previous year, excluding the AED 10.8 billion acquisition stake in ADNOC Gas. Capital expenditure surged by 63.8% to AED 9.15 billion.

Return on equity

TAQA has shown stable return on equity of 7.8% and is poised to benefit from the UAE’s focus on expanding a low-carbon energy sector, as well as the global trend of investing heavily in energy transition assets.

For more insights on market data, please visit ADX Market Watch