Baluchistan Wheels Limited (PSX: BWHL) was incorporated in Pakistan as a public limited company in 1980. The principal activity of the company is the manufacturing and sale of automotive wheel rims for cars, buses, trucks, tractors, and mini-commercial vehicles.

Pattern of Shareholding

As of June 30, 2024, BWHL has a total of 13.334 million shares outstanding which are held by 1369 shareholders. Directors, their spouses, and minor children have the majority stake of around 46.10 percent in the company followed by the local general public holding 26.01 percent shares of the company. NIT accounts for 9.96 percent shares of BWHL while Insurance companies hold 2.56 percent shares. The remaining shares are held by other categories of shareholders.

Historical Performance (2019-24)

BWHL’s topline and bottomline which had been dwindling until 2020 posted a staggering turnaround in 2021 and 2022 only to fall back in 2023. This was followed by a recovery in both the top line and bottom line in 2024. In 2019, gross and operating margins considerably improved while net margins slightly ticked down. In 2020, all the margins slid followed by phenomenal growth in the subsequent two years. In 2023, gross and operating margins plunged while net margins slightly improved. In 2024, all the margins considerably rebounded to boast their optimum level (see the graph of profitability ratios). The detailed performance review of the period under consideration is given below.

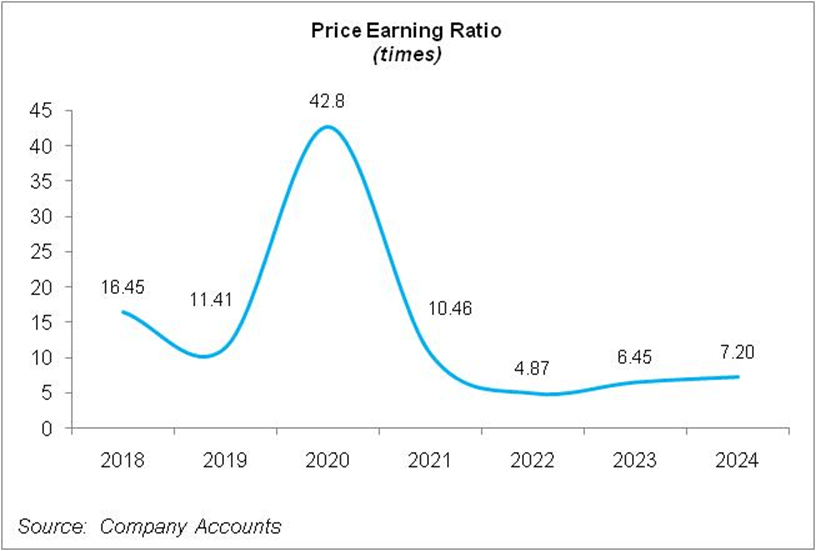

In 2019, BWHL’s net sales plunged by 15.67 percent year-on-year to clock in at Rs.1587.56 million. This came on the back of a decline in the sales of tractor and truck/bus wheels which dropped by 35 percent and 45 percent respectively during the year. While there was a marginal 7 percent year-on-year growth in the sale of car wheels, it couldn’t offset the hit coming from other categories. Overall, the auto sector didn’t perform well in 2019 due to a meteoric rise in the prices of vehicles on the back of the steep depreciation of the Pak Rupee, a high discount rate that restrained auto financing, and high petroleum prices during the year. Tractor sales dropped due to low production of cotton crops during the year while trucks and buses sales also plummeted owing to a slowdown in CPEC-related activities. The company utilized 79 percent of its production capacity in 2019 versus 96 percent capacity utilization recorded in the previous year. This resulted in a 16.8 percent year-on-year drop in the cost of sales. Underutilization of plant capacity increased fixed cost per unit, however, the company passed on the onus of increased cost to its customers which resulted in the GP margin improving from 14.34 percent in 2018 to 15.48 percent in 2019. Distribution expense slid by 25.24 percent year-on-year in 2019 due to lower carriage and forwarding charges as the company was unable to acquire new orders from OEMs. Administrative expenses marginally grew by 0.56 percent year-on-year in 2019 on account of higher payroll expenses despite a drop in the number of employees from 290 in 2018 to 272 in 2019. Higher exchange loss due to Pak Rupee depreciation pushed up other expenses by 51.39 percent year-on-year in 2019. This was partially offset by considerable growth in other income due to gain on the sale of property, plant, and equipment in 2019 coupled with a write-off of liabilities that were no longer payable. Despite controlled expenses, operating profit shrank by 8.14 percent year-on-year in 2019; however, OP margin grew to 6.35 percent from 5.83 percent in 2018. BWHL recorded a debt-to-equity ratio of 14 percent in 2019 which dropped from 15 percent in 2018. However, the high discount rate resulted in a 252.41 percent surge in finance costs in 2019. The bottom line dropped by 18.54 percent year-on-year in 2019 to clock in at Rs. 71.51 million with an NP margin of 4.5 percent versus an NP margin of 4.66 percent posted in the previous year. EPS dropped from Rs.6.58 in 2018 to Rs.5.36 in 2019.

2020 proved to be even worse for BWHL whereby its topline substantially dropped by another 42.5 percent year-on-year to clock in at Rs.912.82 million. The outbreak of COVID-19 proved to be disastrous for the automobile sector with a massive drop in sales across categories. However, it is pertinent to note that while COVID-19 hit the economy in the last quarter of 2020, vehicle sales had already dwindled since the beginning of the year due to restrictions of car purchases on non-filers, high discount rates which had put brakes on auto financing as well as locust attack and water shortage in Sindh and Punjab region which took its toll on the agricultural output and contained the purchasing power of farmers resulting in low tractor sales. BWHL’s plant capacity utilization drastically dropped to 42 percent in 2020 due to tamed demand. Cost of sales dropped by 40.72 percent year-on-year in 2020. Not only did gross profit crash by 52.23 percent year-on-year in 2020, GP margin also tumbled to 12.86 percent. This was unlike 2019 where the company was able to strengthen its margins despite a sales drop. Operating expenses slumped by 15 percent year-on-year in 2020 principally due to lower carriage and forwarding and lower salaries expense. Other expenses dropped by 85.77 percent year-on-year due to no exchange loss incurred during 2020. Other income was magnified by a substantial 454.81 percent in 2020 due to higher profit on Treasury bills and savings accounts. This pushed other income up from 0.32 percent of sales in 2019 to 3 percent of sales in 2020. Curtailed expenses and stunning growth in other income couldn’t prevent operating profit from sliding by 74.14 percent year-on-year in 2020. OP margin radically dropped to 2.85 percent in 2020. Although BWHL’s loan book increased during the year as the company obtained SBP’s refinance scheme for the payment of salaries and wages in 2020, finance costs dropped by 65.35 percent year-on-year in 2020. BWHL’s net profit plummeted by 73.54 percent year-on-year in 2020 to clock in at Rs.18.92 million with an NP margin of 2.07 percent – the lowest ever posted by BWHL. EPS dipped to Rs.1.42 in 2020.

The gloomy times drew to a close in 2021 as BWHL posted a staggering 72.52 percent year-on-year growth in its topline which clocked in at Rs.1574.82 million. Owing to monetary easing and the revival of economic activity post-COVID-19, the auto industry boasted a strong turnaround in 2021. Strong agricultural yield also buttressed the demand for tractors during the year. This had a positive impact on the sales of BWHL in 2021. The sales of cars, trucks/bus as well, and tractor wheels posted an exciting growth of 23 percent, 133 percent, and 144 percent respectively in 2021. The plant capacity utilization grew to only 44 percent in 2021 despite robust demand. Maybe, the company had leftover finished goods inventory from previous years due to lackluster sales since 2018. Cost of sales grew by 67.43 percent year-on-year in 2021. Gross profit rose by 107 percent year-on-year in 2021 and GP margin also greatly improved to 15.43 percent. Operating expenses grew by 21 percent year-on-year in 2021 due to high outward freight charges as demand recovered. High salaries and wages also pushed up the operating expenses in 2021. Increased provisioning for WWF and WPPF pushed other expenses up by 488.34 percent year-on-year in 2021. Other income also doubled in 2021 mainly on account of profit on treasury bills, sale of waste materials as well as gain on the sale of operating fixed assets. Operating profit multiplied by 459.65 percent year-on-year in 2021 with an OP margin of 9.26 percent. Despite the low discount rate during the year, finance costs magnified by 79.18 percent year-on-year in 2021 due to expansion in BWHL’s loan book during the year. This resulted in a debt-to-equity ratio of 18 percent in 2021 versus a debt-to-equity ratio of 17 percent registered in 2020. BWHL’s bottom line grew by 432.13 percent year-on-year in 2021 to clock in at Rs.100.68 million with an NP margin of 6.39 percent. EPS also surged to Rs.7.55 in 2021.

2022 was another exciting year for BWHL where it posted a 76.41 percent year-on-year rise in topline owing to rapid economic recovery which stimulated automobile sales. Cars, trucks/buses, and tractor wheels posted sales growth of 110 percent, 34 percent, and 54 percent respectively in 2022. BWHL’s plant capacity utilization increased to 76 percent in 2022. The cost of sales grew by 62.68 percent due to the Pak Rupee depreciation and commodity supercycle in the global market. However, with upward revision in prices and increased demand, gross profit posted a strong growth of 151.64 percent in 2022 with GP margin climbing up to 22 percent – a level never seen since 2016. Operating expenses grew by 29 percent year-on-year in 2022 due to a hike in salaries and wages owing to inflation as well as high freight charges. Higher provisioning for WWF and WPPF coupled with high exchange loss culminated in a 389.77 percent increase in other expenses in 2022. Other income slid by 6.12 percent year-on-year in 2022 due to lesser gain on the sale of operating fixed assets and unrealized loss on change in fair value of listed securities. Despite high expenses, operating profit grew by 194.53 percent year-on-year in 2022 with OP margin rising as high as 15.45 percent. Regardless of the high discount rate in 2022 due to multiple rounds of monetary tightening, BWHL’s finance cost slid by 5.69 percent year-on-year as the company largely settled its long-term loans during 2022. The bottom line enlarged by 106.83 percent year-on-year in 2022 to clock in at Rs.208.24 million with an NP margin of 7.5 percent. EPS flew to Rs.15.62 in 2022.

After two blissful years, BWHL kicked off 2023 on a dismal note as its topline slid by 39.68 percent year-on-year to clock in at Rs.1675.86 million. The sales of car, tractor, and truck/bus wheels shrank by 55 percent, 53 percent, and 43 percent respectively. Dwindling foreign exchange reserves resulted in import restrictions which created immense supply chain impediments for the OEMs and resulted in the shutdown of their operations. On the other hand, tamed demand for automobiles due to high prices, high discount rates, and low purchasing power of consumers also hit the auto industry hard in 2023. Owing to lesser orders, BWHL also suspended its operations twice during 2023. Cost of sales tumbled by 37.69 percent year-on-year due to depressed sales volume. This resulted in a 46.71 percent year-on-year slide in gross profit with GP margin moving down to 19.45 percent in 2023. While distribution expense slumped by 14.18 percent in 2023 due to lesser freight charges, administrative expense posted a 3.42 percent year-on-year uptick due to the inflationary effect. BWHL squeezed its workforce from 217 employees in 2022 to 207 employees in 2023. Other expenses inched down by 18.69 percent in 2023 due to lower profit-related provisioning which offset higher exchange loss incurred during the year. Other income posted 92.52 percent year-on-year growth due to tremendous profit on treasury bills owing to the high discount rate. Other income stood at 6 percent of BWHL’s topline in 2023 versus 1.89 percent in 2022. Operating profit declined by 51.72 percent year-on-year in 2023with OP margin falling down to12.37 percent. Finance cost grew by 39.81 percent year-on-year in 2023 on account of the higher discount rate. Debt-to-equity ratio shrank to 15 percent in 2023 from 19.88 percent in the previous year.BWHL recorded a 34.5 percent year-on-year slide in its net profit in 2023 which stood at Rs.136.406 million with EPS of Rs.10.23 and NP margin of 8.14 percent.

In 2024, BWHL posted a 29.75 percent year-on-year rise in its net sales which clocked in at Rs.2174.48 million. This was mainly on account of improvement in sales volume of tractor wheels in anticipation of robust wheat and cotton crops. Truck/bus wheels sales volume also greatly improved during the year due to improved demand from the assemblers while car wheels sales tumbled during the year due to costly auto financing rates and elevated car prices. The company passed on the onus of cost hikes to its consumers, resulting ina 43.75 percent improvement in gross profit in 2024. GP margin also strengthened to 21.55 percent in 2024. Selling & distribution expenses spiked by 47 percent in 2024 due to higher freight charges and salaries of sales staff owing to improved sales volume. Administrative expenses succumbed to inflationary pressure and surged by 28.74 percent in 2024. BWHL also expanded its workforce from 207 employees in 2023 to 214 employees in 2024 which increased the payroll expense. The company recorded 37.88 percent lower other expenses in 2024 as no exchange loss was incurred during the year.

Other income posted a phenomenal 51 percent year-on-year rise in 2024 to stand at 7 percent of BWHL’s net sales in 2024. Robust other income was the consequence of increased profit from investment in treasury bills as well as exchange gain recognized in 2024. BWHL’s operating profit improved by 71.55 percent in 2024 with OP margin clocking in at 16.36 percent. Finance costs stayed almost intact at last year’s level despite a higher discount rate. This was due to the settlement of outstanding liabilities during the year. BWHL’s net profit picked up by 76.43 percent in 2024 to clock in at Rs.240.665 million with EPS of Rs.18.05 and NP margin of 11 percent.

Recent Performance (1HFY25)

During the first half of FY25, BWHL posted year-on-year growth of 10.92 percent in its net sales which clocked in at Rs.1138.18 million. While car and truck/bus wheel sales grew, tractor-wheel sales dropped during the period. Improvement in car, truck, and bus wheel sales volume was due to stable exchange rates, the decline in auto financing rates, lower inflation, and increased remittances which improved the overall macroeconomic scenario. Cost of sales mounted by 12.37 percent in 1HFY25 due to higher energy tariffs and increased prices of raw materials. This resulted in a 6 percent uptick in gross profit in 1HFY25 with the GP margin clocking in at 21.62 percent versus the GP margin of 22.62 percent recorded during the same period last year. Selling & distribution expenses inched down by 5.26 percent in 1HFY25 probably due to lower sales volume of tractor wheels recorded during the period. Conversely, administrative expense ticked up by 7.28 percent in 1HFY25 owing to inflationary pressure. Other expenses grew by 23.15 percent in 1HFY25; however, it was conveniently offset by 30.82 percent higher other income recorded during the period. Robust other income was the consequence of realized gain on investment at FVTPL and gain on sale of operating fixed assets recognized during the period. BWHL recorded 15.89 percent growth in

its operating profit in 1HFY25 with OP margin clocking in at 17.19 percent versus OP margin of 16.45 percent recorded in 1HFY24. Finance cost tapered off by 51.83 percent in 1HFY25 due to a lower discount rate and lower outstanding liabilities. Net profit eroded by 5.71 percent to clock in at Rs.114.93 million in 1HFY25. This translated into EPS of Rs.8.62 in 1HFY25 versus EPS of Rs.9.14 recorded during the same period last year. NP margin also dipped from 11.88 percent in 1HFY24 to 10.10 percent in 1HFY25.

Future Outlook

Punjab tractor scheme for farmers will provide impetus to tractor sales in the coming months of FY25. A low discount rate, easing inflation, and a low base of FY24 will also buttress car sales resulting in demand recovery for BWHL. Downside risks include low disposable income and a slowdown in the agricultural sector.

Comments