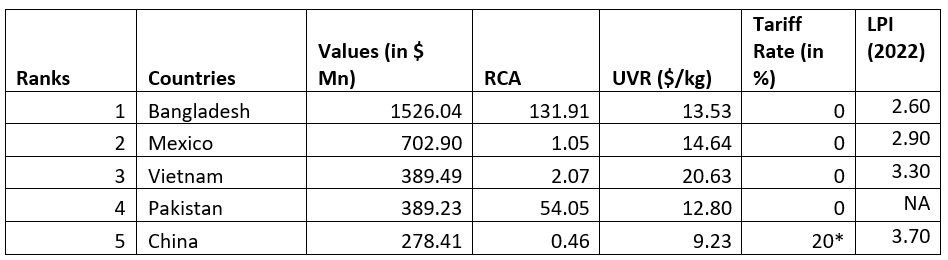

Table 1: Key Exporting Countries and Trade Statistics - Women’s Cotton Trousers and Shorts to the US In CY 2024

Source: TradeMap and F2F Analysis, * Effective from 4th March 2025

Note: RCA - Revealed Comparative Advantage; UVR - Unit Value Realisation; LPI - Logistic Performance Index

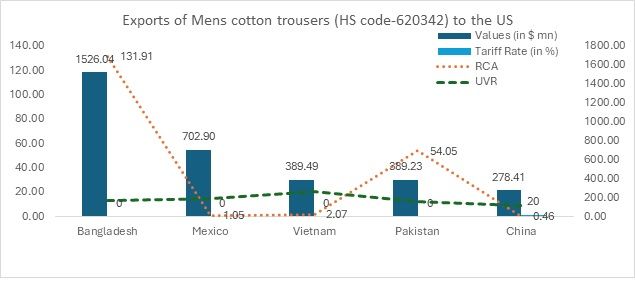

Figure 1: Key Exporting Countries and Trade Statistics - Women’s Cotton Trousers and Shorts to the US In CY 2024

Source: TradeMap, F2F Analysis

Bangladesh: A major winner with strong cost competitiveness

Bangladesh holds the highest Revealed Comparative Advantage (RCA) in the market for women’s cotton trousers and shorts, with an impressive score of 72.80. This underscores the country’s strong competitive edge in producing these garments at highly competitive prices. Additionally, Bangladesh maintains a relatively low Unit Value Realisation (UVR) of $15.62/kg, further boosting its attractiveness to cost-conscious consumers in the US. The absence of tariffs on Bangladesh’s exports enables the country to capitalise on its cost-efficient production, securing a substantial share of the US market and strengthening its position as a leading supplier in this segment.

Vietnam: Competitive but faces challenges with UVR

Vietnam, with an RCA of 1.16, stands in second place in the export rankings for supplying women’s cotton trousers and shorts to the US. Despite a fairly low RCA relative to Bangladesh, its UVR of $18.52/kg is indicative of its slightly higher pricing compared to lower-cost producers like Bangladesh and Pakistan. While Vietnam has free market access on its exports of women’s cotton trousers and shorts, the higher UVR may limit its ability to compete in the low-cost segment coming from Bangladesh. However, Vietnam's overall export values at $707.08 million demonstrates its strong, stable market presence in the US. The nation’s ability to provide higher-quality garments may still secure a place for it among fashion-forward US consumers.

China: Tariffs threaten to disrupt competitive advantage

China, traditionally a dominant supplier of women’s cotton trousers and shorts to the US, currently ranks as the third-largest exporter in this category, with an RCA of 1.22 and a UVR of $8.31/kg. Its low UVR has long positioned China as the preferred source for affordable, mass-produced garments.

However, the recent tariff hikes are set to challenge China’s cost advantage. A 10 per cent tariff on Chinese exports to the US, was imposed effective from February 4 to March 3, 2025, followed by a steeper 20 per cent tariff from March 4, 2025, onwards. Given that China’s affordability has been a key factor in its dominance, these tariffs are expected to erode its stronghold in the US market.

Tariff impact: With the first tariff imposition on February 4, 2025, the tariff rate increased to 10 per cent. This rise in the tariff would have led to an increase in the UVR as production and export costs escalate. As a result, the UVR would have likely increased to around $9.14/kg, reflecting the growing challenges posed by the higher tariffs. The increase in the UVR shows that the products are becoming more expensive, which could make them less competitive in price-sensitive markets.

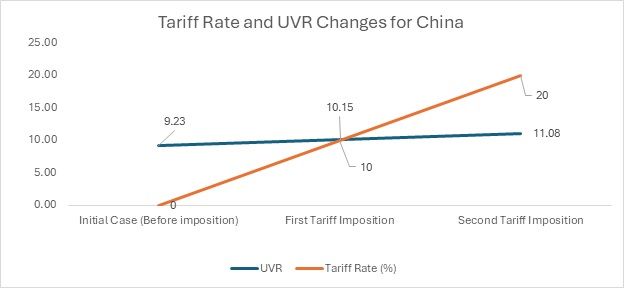

Figure 2

Source: F2F Analysis

In the second tariff imposition, effective from March 4, 2025, the tariff rate rose further to 20 per cent. This significant rise would push the UVR to approximately $ 9.97/kg, reflecting the increasing challenges from low-priced suppliers like Bangladesh and Pakistan.

Pakistan: Competitive position with modest growth

Pakistan, with an RCA of 67.61, is another key player in the US market for women’s cotton trousers and shorts. With a UVR of $15.93/kg, it sits in a competitive price range similar to Bangladesh, which makes it an attractive option for cost-conscious US buyers. Pakistan’s export value of $441.36 million places it in the fourth position. While the country does not face any tariffs, its growth trajectory appears more stable rather than accelerating rapidly like Bangladesh’s. Nonetheless, its strong competitive pricing should allow it to maintain its share in the US market, especially if China loses ground due to tariff hikes.

Cambodia: A niche player with high comparative advantage

Cambodia ranks fifth in the market with an RCA of 20.34, which is higher than that of Vietnam and China. However, its UVR of $14.53/kg is slightly more affordable than Vietnam’s and aligns more closely with Bangladesh’s. This places Cambodia in a strong position to cater to mid-range pricing segments. With an export value of $324.67 million, Cambodia is likely to continue growing, especially as companies diversify their supply chains away from China. The absence of tariffs and the nation’s increasing prominence in global textile exports could position Cambodia as a strong competitor in the US market. Cambodia, however, has a below average Logistics Performance Index (LPI) compared to Bangladesh, leading to a lower probability of it winning from Bangladesh in case of China’s exit from the market.

Outlook

Bangladesh, Pakistan, and Cambodia demonstrate high RCA in the export of women’s cotton trousers and shorts, indicating their strong competitiveness in this segment. Their ability to supply these garments at competitive costs, closely aligned with the UVR, reinforces their market strength. These countries benefit from relatively low production costs, well-established supply chains, and favourable trade agreements, allowing them to maintain a strong foothold in the US market.

In contrast, Vietnam and China exhibit relatively lower RCAs, suggesting they are less competitive in this product category. However, their market positioning differs significantly. Vietnam has positioned itself as a supplier of higher-value, premium-priced products, often targeting segments that prioritise quality, design, and branding. On the other hand, China remains the lowest-cost supplier, with an average unit price of $9.97/kg, making it an attractive option for budget-conscious buyers.

Despite China’s cost advantage, the imposition of higher tariffs has significantly impacted its competitiveness in the US market. With tariffs raising the landed cost of Chinese products by at least 20 per cent compared to previous levels, US buyers may not continue to choose Chinese women's cotton trousers for their daily needs. This slight shift could benefit suppliers from Bangladesh, Pakistan, and Cambodia, thus altering the competitive landscape in the women’s cotton trousers and shorts market.

Fibre2Fashion News Desk (NS)