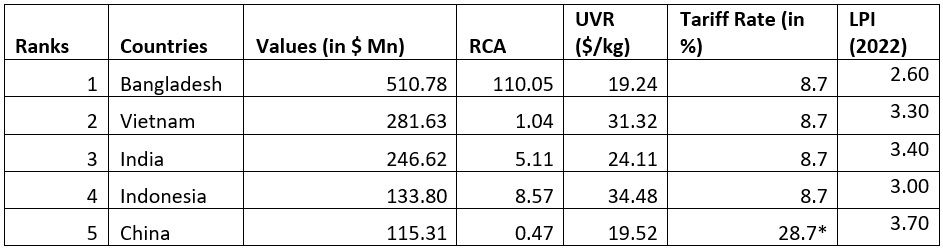

Table 1 highlights the major players in this sector, analysing their export values, Revealed Comparative Advantage (RCA), Unit Value Realisation (UVR), and the tariff rates they face. A detailed assessment of these factors provides crucial insights into each country’s competitiveness in the US market.

Table 1: Top 5 Exporting Countries and Trade Statistics in CY 2024 - Men’s Cotton Shirts (HS code 620520)

Source: TradeMap and F2F Analysis, *Effective March 4, 2025

Note: RCA - Revealed Comparative Advantage; UVR - Unit Value Realisation; LPI - Logistic Performance Index

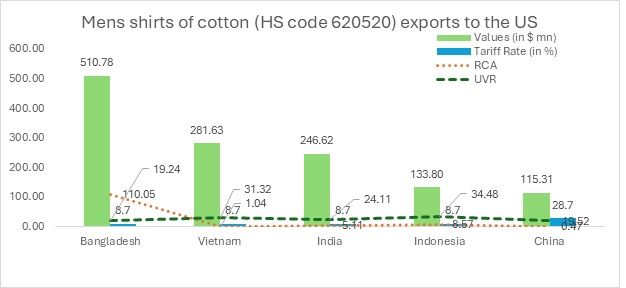

Figure 1: Top 5 Exporting Countries and Trade Statistics in CY 2024 - Men’s Cotton Shirts (HS code 620520)

Source: TradeMap and F2F Analysis

Bangladesh: Leading exporter with strong RCA and competitive pricing

Bangladesh leads the US men’s cotton shirt market with an impressive export value of $510.78 million in 2024. With a remarkable Revealed Comparative Advantage (RCA) of 110.05, Bangladesh holds a significant edge in the production and export of men’s cotton shirts. This strong positioning enables the country to achieve economies of scale, allowing it to dominate the low-to-mid price segments.

Despite facing a tariff of 8.7 per cent, Bangladesh remains highly competitive in the US market. Its combination of a high RCA, a moderate Unit Value Realisation (UVR) of $19.24/kg, and relatively reasonable tariffs gives it a distinct pricing advantage over other suppliers. Given these factors, Bangladesh is well-positioned not only to sustain but also to expand its market share in the US, capitalising on shifts in trade dynamics.

Vietnam: Strong exporter but facing challenges with high UVR

Vietnam holds the second position in the US men’s cotton shirt market, with a strong export value of $281.63 million in 2024. While its RCA of 1.04 indicates only a moderate edge in this category, Vietnam differentiates itself through premium offerings. Its UVR of $31.32/kg, the highest among top exporters, positions Vietnamese cotton shirts in the mid-to-high price range.

Like Bangladesh, Vietnam faces an 8.7 per cent tariff, which does not significantly impact its pricing strategy. However, its relatively high UVR, combined with the tariff, places Vietnamese products in a more premium segment. This could limit its competitiveness in price-sensitive areas, where lower-cost suppliers such as Bangladesh and India are better positioned to capture the market share.

India: Moderate RCA and UVR with competitive pricing

India ranks third in the US men’s cotton shirt market, with an export value of $246.62 million in 2024. Its RCA of 5.11 highlights a strong competitive position, though not as dominant as Bangladesh. With a UVR of $24.11/kg, India’s cotton shirts fall within the mid-range price segment, appealing to a broad customer base.

The 8.7 per cent tariff on Indian exports to the US remains relatively low, allowing India to maintain its competitiveness across both low and mid-priced segments. This balanced positioning enables India to attract diverse buyers while competing effectively with both premium suppliers like Vietnam and cost-efficient producers such as Bangladesh.

India may not be able to fully capitalise on the market gap left by China due to the potential threat of reciprocal tariffs. The announcement by President Donald Trump of possible tariff measures, set to take effect on April 2, could disrupt the current trade dynamics. This uncertainty may undermine India’s competitive position, limiting its ability to gain significant market share from China’s decline.

Indonesia: Strong exporter with high UVR

Indonesia ranks fourth in the US men’s cotton shirt market, with an export value of $133.80 million in 2024 and a strong RCA of 8.57, highlighting its competitive edge in cotton shirt production. With a UVR of $34.48/kg, the second highest after Vietnam, Indonesia’s products are positioned in the premium segment.

Like Vietnam and India, Indonesia faces an 8.7 per cent tariff, which remains manageable. However, its high UVR suggests that Indonesian cotton shirts are priced higher than those from lower-cost exporters. This could be attributed to higher production costs per unit, possibly reflecting lower economies of scale. As a result, Indonesia’s ability to compete in price-sensitive segments may be limited, making it more reliant on demand for premium-quality products.

China: Struggling with high tariffs and low RCA

China ranks fifth in the US men’s cotton shirt market, with 2024 export value of $115.31 million—significantly lower than the top four exporters. Its RCA of 0.47 indicates a relatively weak competitive position in this sector. With a UVR of $19.52/kg, Chinese cotton shirts fall within the low-to-mid price segment, though not at the most competitive price point. However, China’s affordability still makes it an attractive option for price-sensitive consumers.

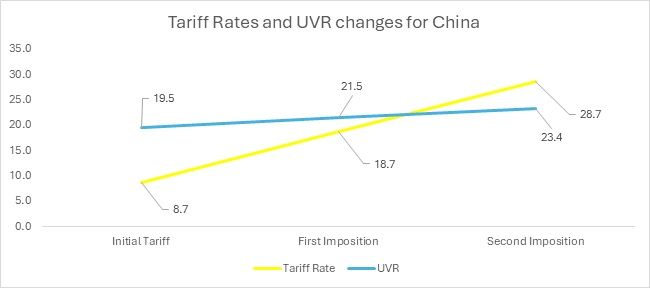

Previously, China operated under the Most Favoured Nation (MFN) tariff structure, maintaining a level playing field in this category. However, recent tariff increases have drastically changed its competitive landscape. From February 4 to March 3, an additional 10 per cent tariff raised China’s effective rate to 18.4 per cent. This was followed by another 10 per cent hike on March 4, bringing the total tariff to a staggering 28.7 per cent.

These escalating tariffs not only erode China’s cost advantage but also push up its UVR, which has been a key selling point of its budget-friendly products. As a result, China faces increasing pressure in the US market, potentially losing ground to lower-tariff competitors such as Bangladesh and India.

Figure 2

Source: F2F Analysis

As tariff rates increase, China is gradually losing its unique selling proposition (USP) of offering affordable products.

This steady increase in UVR reflects a significant shift away from China’s traditional low-cost positioning, weakening its ability to compete in the price-sensitive segments of the US market.

Outlook

Bangladesh remains the dominant player in the US men’s cotton shirt market, supported by its high RCA, competitive UVR, and a low 8.7 per cent tariff. This combination allows it to offer cost-effective products, strengthening its market leadership.

Vietnam and India, though strong contenders, face challenges due to their higher UVRs, placing them in mid-priced segments. Indonesia, with a UVR of $34.48/kg, must improve its economies of scale to remain competitive, especially as China cedes market share.

China faces the greatest challenge, with a steep 28.7 per cent tariff pushing its pricing into the mid-range category, making it less competitive against lower-cost suppliers like Bangladesh. Despite Bangladesh’s lower Logistics Performance Index (LPI), its dedicated textile export infrastructure further enhances its trade efficiency.

Going forward, it seems like Bangladesh will continue to hold the strongest competitive advantage, while Vietnam and India will retain key market positions in the mid-to-premium segments. Indonesia will likely focus on premium consumers, whereas China’s market share is expected to decline unless it finds ways to offset the tariff impact.

Fibre2Fashion News Desk (NS)