The US has imposed an additional 20 per cent tariff on China and 25 per cent on Mexico, impacting their price positioning. Meanwhile, Nicaragua and Honduras benefit from zero tariffs, giving them a growing advantage. This analysis examines tariff effects, Revealed Comparative Advantage (RCA), and Unit Value Realization (UVR) to assess how each exporter is adapting to market shifts.

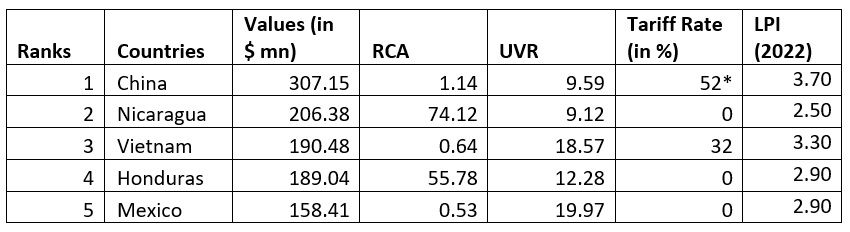

Table 1: Top 5 countries Exporting Non-cotton-based T-shirts (HS code 610990) to the US in CY 2024

Source: TradeMap and F2F Analysis * Effective from 4th March 2025

Note: RCA - Revealed Comparative Advantage; UVR - Unit Value Realisation; LPI - Logistic Performance Index

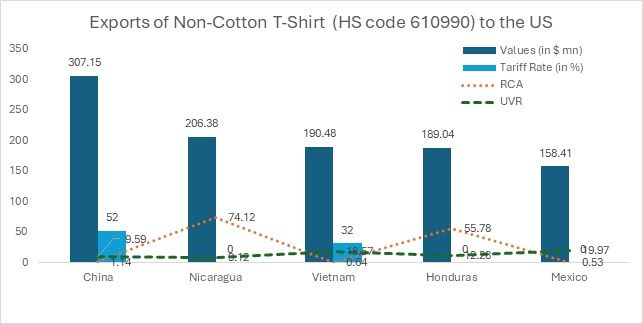

Figure 1: Top 5 countries Exporting Non-cotton-based T-shirts (HS code 610990) to the US in CY 2024

Source: TradeMap and F2F Analysis

China: Leading exporter with high tariff impact

China remains the leading exporter of non-cotton T-shirts to the US with an export value of $307.15 million in 2024. The country has an RCA of 1.14, indicating a moderate comparative advantage in this sector. However, China’s UVR of $ 9.59/kg suggests that its T-shirts are positioned in the lower-to-mid price range, offering affordability and volume production, which makes them highly competitive in price-sensitive segments of the market.

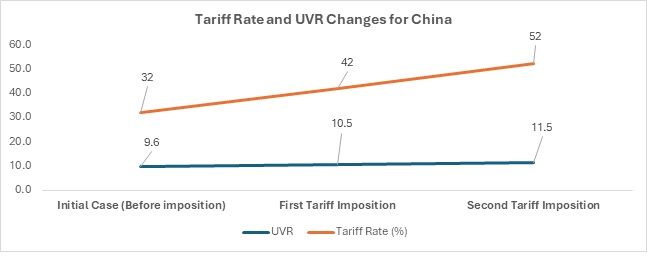

Tariff Impact: China faces a 32 per cent tariff (until February 1, 2025) on its exports of non-cotton T-shirts, significantly increasing the cost in the US market. Despite the high level of tariff, China remained the top exporter to the US in this category. This high tariff burden, coupled with an additional 20 per cent levy effective March 4, 2025, is likely to erode China’s competitive edge, particularly given its relatively low UVR. The steep tariff hike may drive up the price of Chinese non-cotton T-shirts, potentially reducing demand among US consumers who prioritise affordability. Moreover, it will weaken China’s ability to sustain its low-price advantage, creating opportunities for competitors with lower tariff rates, such as Nicaragua and Honduras.

On the other hand, to mitigate the rising costs, China may relocate production, pursue trade agreements, or shift focus towards high-value, innovative products rather than competing on price alone.

Figure 2

Source: F2F Analysis

Nicaragua’s rising competitiveness in the US non-cotton T-shirt market

Nicaragua ranks as the second-largest exporter of non-cotton T-shirts to the US, with an export value of $206.38 million in 2024 and an exceptionally high RCA of 74.12. This strong RCA underscores Nicaragua’s strong competitiveness in the sector.

With a UVR of $9.12/kg, Nicaragua offers pricing comparable to China, making it an attractive sourcing destination for US buyers. However, the key differentiator lies in tariff treatment:

As tariffs continue to push up China’s prices, Nicaragua stands to gain market share by offering similarly priced products without the additional cost burden. US importers seeking cost-effective alternatives are likely to shift sourcing to Nicaragua, further strengthening its position in the US apparel market.

Vietnam: Balancing moderate competitiveness with premium pricing

Vietnam ranks third in non-cotton T-shirt exports, with an export value of $190.48 million. However, its RCA of 0.64 suggests that it does not hold a strong specialisation in this product category.

Vietnam’s UVR of $18.57 is significantly higher than that of China and Nicaragua. This indicates that Vietnamese non-cotton T-shirts cater primarily to higher-end, quality-conscious consumer segments, rather than competing on price alone.

Unlike Nicaragua, which enjoys zero tariffs, Vietnam faces import tariffs of 32 per cent in the US, making its products relatively more expensive. While this poses a challenge in price-sensitive segments, Vietnam’s ability to offer premium-quality apparel helps it maintain a foothold in niche markets where quality and brand perception outweigh cost considerations.

Honduras: Strong competitor with low tariffs and mid-range pricing

Honduras ranks fourth in non-cotton T-shirt exports to the US, with an export value of $189.04 million in 2024. Its RCA of 55.78 highlights a strong specialisation in this product category, reinforcing its competitive position in the global market. With a UVR of $12.28/kg, Honduras falls into the mid-range price segment, offering a balance between affordability and quality. This positions it as an appealing option for US buyers looking for cost-effective yet well-made non-cotton T-shirts.

One of Honduras’ key advantages is its low or zero tariffs on exports to the US, thanks to trade agreements such as CAFTA-DR. This gives it an edge over countries like China, which face steep tariff barriers, and allows it to compete more effectively in the price-sensitive segment of the US market.

Mexico: Trade agreement helps in exports

Mexico ranks fifth in non-cotton T-shirt exports to the US, with an export value of $158.41 million in 2024. However, its RCA of 0.53 indicates a relatively weak specialisation in this segment compared to competitors like Honduras and Nicaragua.

With a UVR of $19.97/kg, the highest among the top five exporters, Mexico’s non-cotton T-shirts are positioned in the premium segment. Despite having zero tariff rate due to the USMCA agreement with the US, Mexico lacks cost competitiveness when compared with other competitors such as Honduras and Nicaragua who face the same preferential tariffs.

Competitive landscape

Nicaragua and Honduras are well-positioned to dominate the US non-cotton T-shirt market, thanks to their zero-tariff status, strong RCA, and competitive pricing. Their proximity to the US further reduces shipping costs and delivery times, giving them a strategic advantage over other exporters.

Shifting market dynamics: China’s declining competitiveness

As China faces rising tariffs, its non-cotton T-shirts are becoming more expensive, making them less attractive to US importers. This shift opens the door for Nicaragua and Honduras to capture a larger share of the price-sensitive market, as they offer cost-effective alternatives without tariff burdens.

Nicaragua vs. Honduras: Who will lead?

Nicaragua’s Strengths: With a high RCA and favourable trade agreements with the US, Nicaragua is poised to become the primary low-cost alternative to China.

Honduras’ Advantage: While also benefiting from zero tariffs, Honduras’ mid-range UVR allows it to cater to both budget-conscious and quality-driven buyers.

Market Outlook

With both Nicaragua and Honduras leveraging duty-free access and efficient logistics, US buyers are likely to shift sourcing away from China. Nicaragua, in particular, stands to gain the most due to its cost-effectiveness and trade policies, while Honduras remains a strong competitor in the mid-tier segment.

Fibre2Fashion News Desk (NS)