The rise, fall, and reinvention of Kaveri Seeds

After a decade of stagnant stock performance, Kaveri Seeds has staged a strong comeback. The company, once heavily reliant on cotton seeds, has successfully diversified into high-margin crops like maize and hybrid rice. Could this shift propel it toward sustained growth?

Kaveri Seeds has since undergone a fundamental transformation.

Kaveri Seeds has since undergone a fundamental transformation.Between 2012 and 2015, Kaveri Seeds Ltd saw its stock price surge tenfold. However, the following decade delivered zero returns, despite the company reporting 25% EPS growth in eight out of those ten years, consistently buying back stock, diversifying away from its cotton seed business.

The turning point came in 2015 when the government imposed price controls on cotton seeds, prompting investors to abandon the stock, which then traded sideways for nearly eight years. But in 2022, the stock surged again, and it seems there’s no stopping it for now.

Source: http://www.tradingview.com

Source: http://www.tradingview.com

Let’s dive in to understand what has changed.

BT cotton seeds

From 2002-2015, BT cotton seeds, India’s first genetically modified (GM) crop, transformed the country’s cotton industry, accounting for over 90% of cotton acreage. When Monsanto introduced GM cotton technology, yields had stagnated, but from 2002-2015, they nearly doubled—from 302 kg/hectare to 550 kg/hectare, while total cotton production rose from 13 million bales to 35 million bales.

However, in 2006, the Andhra Pradesh government fixed prices to Rs 750/packet and limited the trait fee to Rs 49/packet to protect farmers’ interests. Other states followed suit, and by 2015, the Centre brought cotton under the Essential Commodities Act, placing them under strict price regulations.

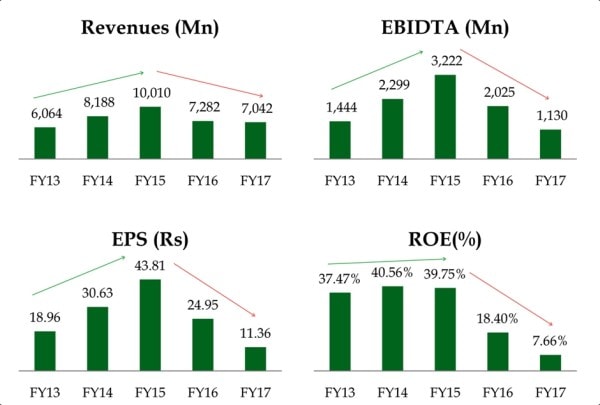

This regulatory move stalled Kaveri Seeds’ growth.

Source: Kaveri Seeds Ltd / Q4FY17 / Investor Presentation

Source: Kaveri Seeds Ltd / Q4FY17 / Investor Presentation

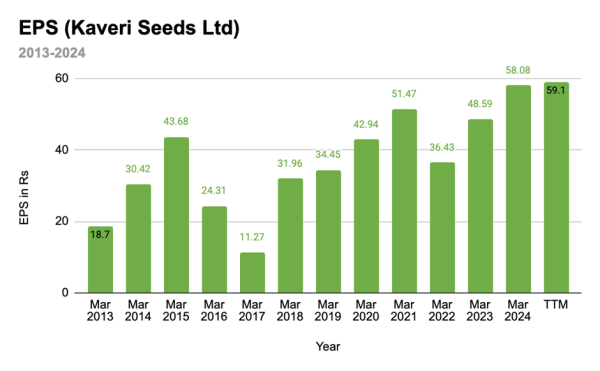

Between 2015 and 2017, the company’s EPS dropped from Rs 44 per share to Rs 11 per share. Not only did it dent Kaveri’s cotton seeds business, but it also hampered India’s cotton industry.

Since then, yields have stagnated, the area under cultivation has only marginally increased, and pest resistance has declined.

In 2021, after a legal battle, Monsanto (now part of Bayer AG) decided to exit the cotton licensing business in India.

The last hybrid cotton seed — Bollgard II — was introduced in 2006.

So, what changed for Kaveri Seeds?

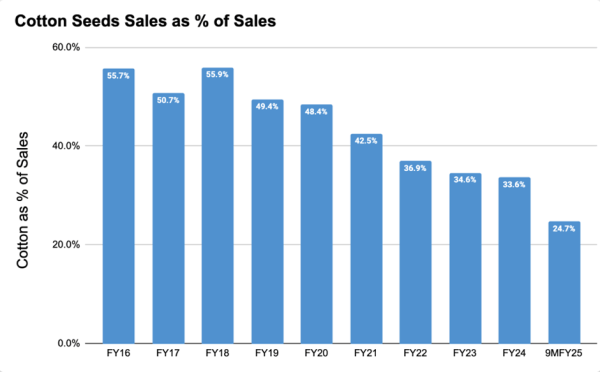

Kaveri Seeds has since undergone a fundamental transformation. In 2016, cotton seeds accounted for nearly 73% of its revenue — a figure that dropped to 33.6% in FY24 and further declined to 25% in the first nine months of FY25. For a company once heavily reliant on the regulated cotton seeds business, this shift is seen as a significant positive.

Source: Kaveri Seeds FY16-FY24 Investor Presentations

Source: Kaveri Seeds FY16-FY24 Investor Presentations

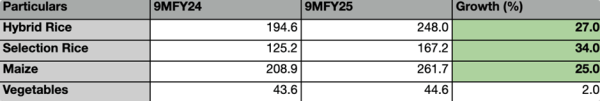

Even as the contribution of the cotton seeds segment is falling, other seeds, such as maize, paddy, bajra and vegetable seeds (which account for 75% of sales), are growing well.

At the same time, other seeds — maize, paddy, bajra, and vegetable seeds — now account for 75% of total sales and continue to grow. These high-margin categories are expected to drive growth in Q1FY26.

Source: Kaveri Seeds / 9 Months comparison FY24 vs FY25 / Investor Presentations

Source: Kaveri Seeds / 9 Months comparison FY24 vs FY25 / Investor Presentations

Financial outlook

Kaveri Seeds anticipates a 10-12% increase in top-line and a 15-20% rise in bottom-line PAT. Revenue growth is expected to be fuelled by increased sales volumes in crucial crops like hybrid rice, selection rice, and maize. The increasing contribution from higher-margin segments like non-cotton is also expected to improve EBITDA margins.

Additionally, the company has hit the Rs 1,000 crore + revenue milestone for the first time in a decade, driven by newer products.

The company has also bought back 28.5% of the total shares outstanding since 2017. As a result, EPS has grown at a 25% CAGR from 11.27 per share to 58.8 per share since 2017. Meanwhile, the stock price went up 12.7% during the same period.

Source: http://www.screener.in

Source: http://www.screener.in

A part of the return was in the form of buyback and, therefore, EPS and stock price returns are not directly comparable.

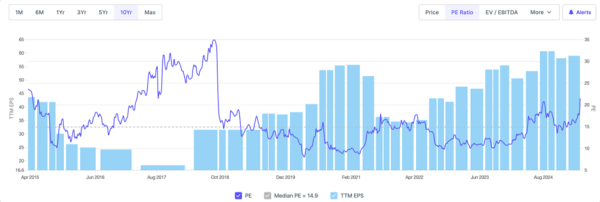

Currently, the company is trading at a price/earnings ratio of 21.5x, which is a premium to its 10-year median of 15x, but it reflects the market’s optimism about FY25.

Source: http://www.screener.in

Source: http://www.screener.in

Assuming a 20% PAT growth YoY, the forward P/E aligns with the long-term average of 15x, suggesting the stock may not be as expensive as it appears, provided revenue in non-cotton seeds continues to rise into FY26.

The road ahead

Kaveri Seeds altered its capital structure by undertaking a massive buyback programme. Whether the new focus areas will drive growth remains to be seen. However, if it does work out, then, perhaps, it won’t be long before stock price returns catch up with the potentially brighter prospects.

Note: We have relied on data from http://www.Screener.in and http://www.tijorifinance.com throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

Rahul Rao has helped conduct financial literacy programmes for over 1,50,000 investors. He has also worked at an AIF, focusing on small and mid-cap opportunities.

Disclosure: The writer or his dependents hold shares in the securities/stocks/bonds discussed in the article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

Must Read

Buzzing Now

Mar 31: Latest News

- 01

- 02

- 03

- 04

- 05