Yesterday, President Donald Trump announced new import taxes on all goods entering the United States. Goods and products from about 60 nations face higher rates in what Trump calls a payback for unfair trade policies. His plan sets a baseline tariff of 10 percent on all imports, effective April 5. Higher duties for certain countries will become effective April 9. How will this play out for the U.S., a country that's largely dependent on imports of fruits and vegetables, according to a recent analysis of Fruit & Vegetable Facts. Tomatoes are the largest import vegetable with Canada and Mexico being the main suppliers. Bell peppers and cucumbers rank second and third. The volume of fresh fruit imports is about twice the volume of fresh vegetable imports with bananas making up the largest category. Other large import products include pineapples, grapes, melons, lemons, blueberries, and mangos.

USMCA agreement

Yesterday's announcements don't change anything for Mexico and Canada, two of America's closest trading partners. For Canada and Mexico, goods compliant under the U.S.-Mexico-Canada Agreement (USMCA), which include specialty crops, are not subject to additional tariffs. "IFPA appreciates the administration's decision to allow continued trade of fresh produce and florals covered under the U.S.-Mexico-Canada Agreement (USMCA)," says Cathy Burns, IFPA CEO in a statement. "Fresh fruits, vegetables, and florals are among the most highly traded commodities across North America and beyond. Reducing trade barriers ensures that consumers continue to have access to fresh, affordable produce and floral products while supporting the growers and businesses that sustain the industry." However, IFPA remains concerned about the broader application of tariffs on global trading partners and the resulting disruptions to supply chains, market stability, and food prices worldwide. "The global trade of fresh produce is essential to the health and well-being of people in every nation. Targeted use of tariffs can be a tool for addressing inequities between trading partners, but the broad application of this blunt tool often disrupts markets, raises consumer costs, and places unnecessary strain on growers and producers across the supply chain."

Francisco Meré of Blooms, a provider of capital for exports, is also content with the decision for produce imported from Mexico and the U.S. "We celebrate President Trump's decision to exempt produce imports that are USMCA-compliant from tariffs," he says in a statement on LinkedIn. "Mexico and Canada are the top sources of fresh and frozen produce to meet a substantial part of the USD 100 billion annual demand of American households. This is an important step towards lowering food inflation while meeting the nutrition and healthy choices of consumers."

Tariffs for individual countries

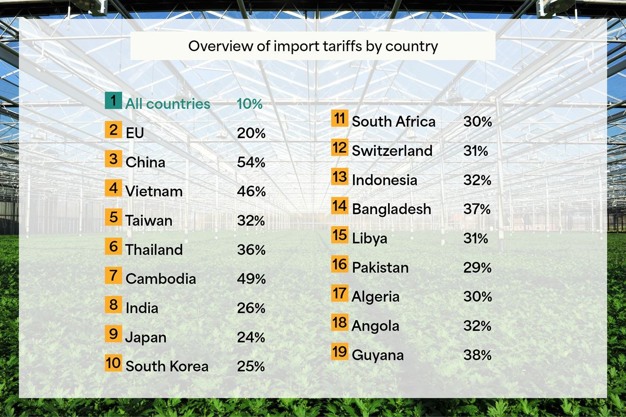

Produce exported from nations outside the North American continent, however, will be faced with a minimum tariff of 10 percent. The European Union and the U.K. are looking at 20 percent and 10 percent respectively. Goods from China will be charged an addition 34 percent, on top of an existing 20 percent tariff, bringing the total levy to 54 percent. See below an overview of tariffs by country.

© Viola van den Hoven-Katsman | FreshPlaza.com

© Viola van den Hoven-Katsman | FreshPlaza.com

Fear of retaliatory tariffs on produce

American Farm Bureau Federation President Zippy Duvall commented on tariffs implemented for trading partners globally. "Trade is critical to the success of farmers and ranchers across the country. We share the administration's goal of leveling the playing field with our international partners, but increased tariffs threaten the economic sustainability of farmers who have lost money on most major crops for the past three years," he says. He is referring to the threat of retaliatory tariffs. "More than 20 percent of farm income comes from exports, and farmers rely on imports for crucial supplies like fertilizer and specialized tools. Tariffs will drive up the cost of critical supplies, and retaliatory tariffs will make American-grown products more expensive globally. The combination not only threatens farmers' competitiveness in the short term, but it may cause long-term damage by leading to losses in market share."

"With the President's announcements, all of the top 5 export markets for U.S. apples have been targeted," says Jim Bair of the U.S. Apple Association. Mexico, Canada, Taiwan, Vietnam and India combined purchased $756 million worth of U.S. apples in 2024. "Now we wait nervously for their reaction and hope for calm," Bair added.

Main buying nations of U.S. apples

© Jim Bair, U.S. Apple

© Jim Bair, U.S. Apple

Reaction from the European Union

Nations outside the United States are also responding to the tariff announcements. The European Union is concerned these tariffs will only lead to further tariff escalation and a downward economic spiral for the U.S. and the world as a whole. "Because of Trump's decision, U.S. consumers will be forced to carry the heaviest burden in a trade war," says Bernd Lange Chairman of the European Parliament's International Trade Committee. "While President Trump might call April 2 'Liberation Day', from an ordinary citizen's point of view this is 'Inflation Day'." The EU plans to respond through legal, legitimate, proportionate and decisive measures. "The countries that have been targeted by these measures must respond with a united front and send a clear message to the U.S. to end this tariff madness." While Lange hopes the U.S. administration is interested in engaging with the EU, he is not confident.

Australia is disappointed

The U.S. imposed a 10 percent tariffs on products imported from Australia, but New South Wales Farmers President Xavier Martin urges farmers to stay calm. "There's no doubt our industry will feel the effects, some commodities more than others, but we have worked through trading issues before and we'll do it again." While the U.S. imports some produce items from Australia, the country mainly focuses on fruit and vegetable exports to China, Japan, and South Korea worth $3.9 billion, $2.6 billion, and $2.5 billion respectively. Meat is the largest export category for Australia and the Red Meat Advisory Council estimates the total impact to the American consumer as a result of tariffs on Australian red meat would be AU$600 million, equaling US$380 million.

South America

Peru, Chile, and Colombia are some of South America's largest exporters of fresh produce to the U.S. and the continent's share has rapidly grown in recent years. Most countries in South America seem to be hit with a 10 percent tariff, which is significant given the value of produce they export to the U.S. annually. Peru is a significant provider of table grapes, blueberries, asparagus, avocados, and citrus fruits to the U.S. market. In 2023, the country was the largest exporter of fresh fruits to the U.S. after Mexico with a value of $2,277 million. Chile is the third largest exporter of fruit to the U.S. with citrus, berries, table grapes cherries, stone fruit and avocados being some of the largest categories.

Big contrast in Africa

South Africa, exporter of citrus fruits, grapes, stone fruit to the U.S. has been slammed with a 30 percent tariff. When asked to comment, one U.S. importer said details of these new tariffs still need to be studied to determine their full impact. Moroccan exporters felt a sense of relief as they are impacted by a 10 percent tariff, which is viewed as a privilege. Citrus fruit is the largest category exported to the U.S, but a category like blueberries has been experiencing strong growth in exports recently. Up until now, trade between Morocco and the United States was governed by a free-trade agreement with the trade balance being in favor of the U.S., explaining the low tariff.

All in all, these import tariffs add a lot of uncertainty to an industry that has been faced by headwinds such as the pandemic, economic downturns, logistics issues, and increasing input costs. In the coming days, updates will be published as more information becomes available.

Sources: IFPA, Fruit & Vegetable Facts, AFBF, European Parliament, NSW Farmers