How will Vietnam handle Trump’s trade escalation?

How will Vietnam handle Trump’s trade escalation?

The United States has announced he will impose 46 per cent tariffs on Vietnamese imports, one of his most aggressive trade moves and the third-highest rate imposed on any country. Craig Martin, chairman of Dynam Capital, explores how this will affect Vietnam going forward, and what can be done in response.

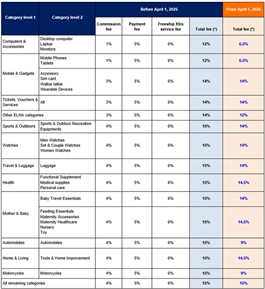

Chart of reciprocal tariffs. Courtesy: US President Donald Trump via Truth Social |

US President Donald Trump imposed tariffs on more than 100 countries, adding to several levies he has already imposed on Mexico and Canada, as well as steel, aluminium, vehicles, and parts.

The White House has not revealed its methodology, but there have been suggestions that each country’s tariffs are assessed by simply dividing their surplus with the US by their exports to the US. The “reciprocal” tariffs appear to be calculated at half this rate.

The key question for Vietnam now is how it will minimise the impact of these new tariffs, and how it might negotiate to try to lower them.

Vietnam has a lopsided trade relationship with the US. In 2024, Vietnam had the third-largest goods trade surplus with the US after China and Mexico, growing by 18 per cent over the previous year to $123.5 billion. Unlike some other major US trading partners, Vietnam imports few US goods to help balance the ledger.

Moreover, Vietnam has long-faced accusations that its manufacturers were re-badging goods to help Chinese manufacturers skirt existing tariffs, adding little or no value locally. A recent Wall Street Journal analysis found that there was still a strong correlation between Vietnam’s imports from China and its exports to the US.

On the other hand, a recent Harvard Business School working paper found that rerouting is less common than previously thought. An analysis by the Lowy Institute suggested that three-quarters of imports from China “can be explained by factors other than hidden Chinese exports to America” and that Vietnam is “playing a helpful role in the diversification of US supply chains away from China”. But perception matters, and Washington believes it’s a problem.

How much will it hurt?

Data analytics firm Exiger calculated that Vietnamese goods would face $63 billion in tariffs. There’s no getting around it: this is likely to have a negative impact on Vietnam’s economy, at least over the short term.

There are still many unanswered questions about how the tariffs will work in practice, and it’s entirely possible that the headlines won’t match the reality. Even so, Vietnam’s growth strategy is tangled up in trade. Trump’s blanket 10 per cent global tariff will dampen growth globally, which could dent Vietnam’s export ambitions.

It might also have an impact on foreign investment. Vietnam faces higher tariffs than many neighbouring economies, such as Thailand at 35 per cent, Indonesia 32 per cent, Malaysia 24 per cent, and the Philippines 17 per cent. A business that’s considering establishing a factory in Asia is likely to take this into consideration.

This is more likely to affect higher-value manufacturing projects. Similarly, high tariffs on Cambodia and Bangladesh mean that there is less likely to be an impact on Vietnam’s textiles or shoe factories.

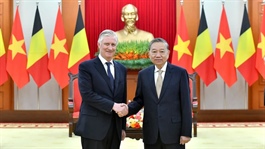

The good news is that Vietnam has a few cards up its sleeve. Hanoi is already working hard to get Washington to change course. Notably, Trump was very complimentary in his remarks on Vietnam, even if he was sharply critical of their trade policies.

Hanoi is appealing to the president and his allies personally. The Trump organisation reportedly plans to invest billions of dollars in Vietnam’s golf courses, hotels, and real estate. Similarly, the government has granted Elon Musk’s SpaceX permission to trial its Starlink satellite internet service in Vietnam.

Vietnam is very unlikely to follow Canada or Europe in applying reciprocal tariffs. At present, it imports too few US goods to impose any real pain. The flip side is that it wouldn’t have to increase imports by an unreasonable amount to lower the surplus.

In March, US and Vietnamese companies signed more than $4 billion in deals, mostly for oil and gas exploration. Its furniture industry is eyeing more hardwood imports from the US. It may also look at soy imports and aircraft purchases from Boeing. Vietnam is sending a deputy Prime Minister (formerly from the Ministry of Finance) as part of a delegation to the US this weekend.

Moreover, Vietnam has already announced it would slash tariffs on various agricultural products such as frozen chicken legs, pistachios, almonds, fresh apples, cherries, and raisins. It will cut the tariff on liquefied natural gas from 5 per cent to 2 per cent. Duties on cars will be reduced considerably to 32 per cent, and tariffs on ethanol will be halved to 5 per cent.

Playing the long game

As Vietnam tries to make its case, it will likely use certain geopolitical advantages. If US-China tensions grow - not unlikely given the tariffs are largely aimed at China specifically - Washington might see value in cultivating better ties with Hanoi, which has a complicated relationship with its northern neighbour.

Also, unlike Canada and Mexico, Vietnam doesn’t share a border with the US. Trump’s first tariffs were on Canada and Mexico, allegedly to pressure them on fentanyl and immigration. Neither issue is a sticking point with Hanoi.

Some of the biggest Vietnamese businesses already have a presence in the US, mainly because they want access to the world’s most lucrative market. Tech leader FPT has been in the US since 2008. Carmaker VinFast is already selling vehicles in the US and has plans to open a factory there.

This process might accelerate under Trump, but it will be difficult to fully know the impact of the tariffs, as they will rarely be the sole reason for a Vietnamese business expanding in the US. more than 100 Vietnamese enterprises have registered to attend an event to learn about investment and business opportunities in the US. However, the current regulatory environment makes it relatively difficult for Vietnamese businesses to invest overseas, so there might be limits to this approach.

At the same time, Asia has been the engine of global economic growth for decades now, and one inevitable result is that trade within the region is more significant than ever, facilitated by a network of free trade agreements. For this reason, Vietnamese businesses might vote with their feet and focus more energy on capturing customers across Asia-Pacific instead of the US.

The tariffs will clearly have some impact on Vietnam. However, this must be measured against greater fundamentals. The most recent GDP growth figures topping 7 per cent. Foreign investment is growing. Industrial production is up. Vietnam has a young, tech-savvy and increasingly educated population, which is fuelling a growing consumer class.

Even if tariffs prove a hurdle over the short term, they’re unlikely to derail Vietnam’s longer-term ambitions.

- 11:54 04/04/2025