Economic vandalism

With Donald Trump having delivered a seismic shock to world trade, and then “back-flipped,” the benefit of a adopting a “cool head” has never been more apparent.

Monday, April 14th 2025, 8:30AM

by Devon Funds

With Donald Trump having delivered a seismic shock to world trade, and then “back-flipped,” the benefit of a adopting a “cool head” has never been more apparent.

March was challenging for markets with investors having to deal with an ever-evolving trade situation. After a month-long pause, Donald Trump’s 25% tariffs on imports from Canada and Mexico came into effect early in the month, before exemptions were granted only a few days later. There was no such reprieve for China which saw doubling of tariffs to 20%. All three nations responded with retaliatory measures and tariffs of their own. The auto sector was also granted a temporary reprieve. Sector specific tariffs were also implemented or proposed.

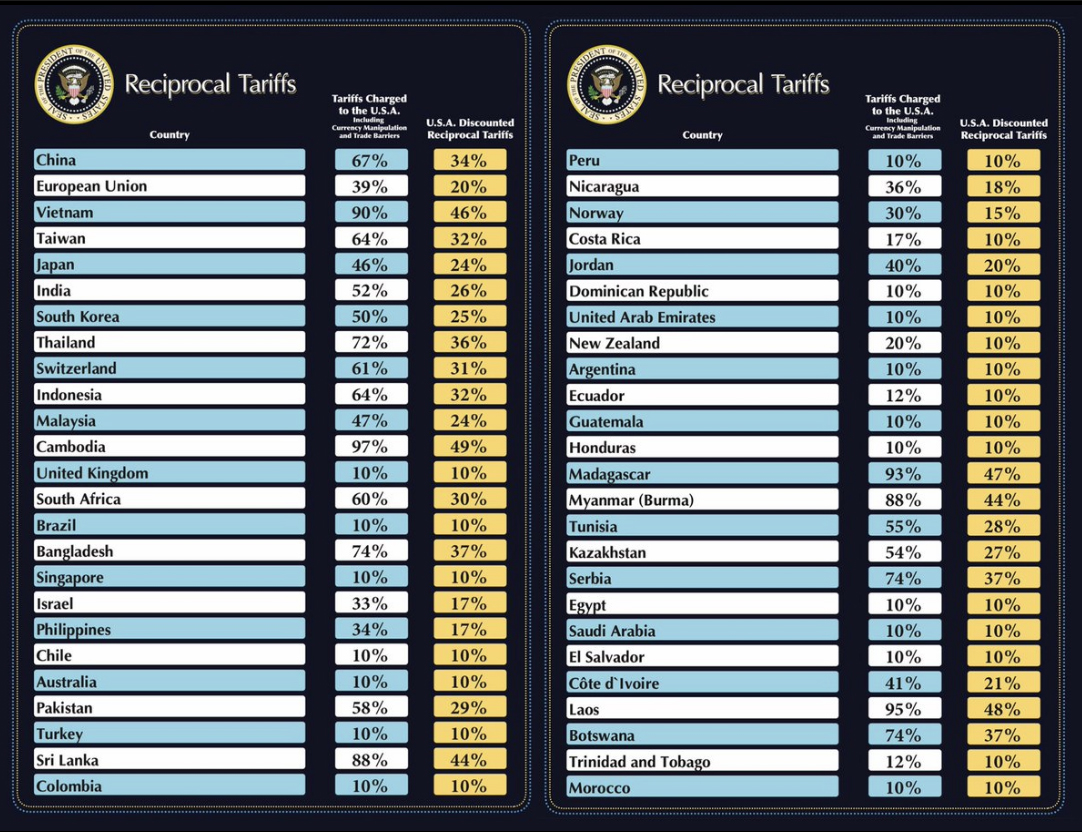

With April underway, Trump delivered a seismic shock to world trade with “reciprocal” tariffs on over 180 countries. Trump announced a “baseline” tariff of 10% and a sliding scale of tariffs, which his administration sees as representing half of what trading partners are charging the US (it is worth noting this includes VAT/GST which does not single out the US). Notably Canada and Mexico are not caught by the new arrangements provided they comply with the USMCA agreement.

The table of economic vandalism

Source: The White house

The market responded viciously to Trump’s tariff plans. The Dow Jones fell over 1500 points in back to-back sessions for the first time ever. The Nasdaq entered bear market territory, while the S&P500 flirted with it. In two sessions the broad benchmark lost some US$5 trillion in market value. The selling was broad based, but technology names came in for extra special attention. Apple lost its mantle as the world’s most valuable company after falling ~20% in a week.

Bond yields have been volatile as investors have considered whether the Fed will be pressed to cut rates to combat the economic damage inflicted on the US via the tariffs at the same time that there is a spike (which will be transitory according to officials) in inflation. Recessionary risks have clearly risen but even before last Thursday’s announcement, growth forecasts had been tapered, and the term “stagflation” (stagnant growth with elevated inflation) had become more prevalent in investment circles.

Estimates were that the average tariff in the US could increase by around 25% to circa 27%, which would be the highest in over 100 years. The Smoot-Hawley Tariff Act was signed in 1930 and raised U.S. tariffs on over 20,000 imported goods to record levels. The intention was to shield American businesses and the agricultural sector from foreign competition during the Great Depression, but it had several unintended consequences including a significant reduction in international trade, retaliatory tariffs, and a more protracted downturn - it also arguably precipitated Germany’s economic decline, the rise of Hitler, and the World War II.

The architects of that tariff policy lost their seats and the Republicans lost the 1932 presidential election, with President Hoover defeated by Democrat Franklin D. Roosevelt in a landslide. The negative effects ultimately saw a more cautious approach to protectionism and the eventual establishment of international trade agreements.

The fallout to the stock market was always likely to play a part in the tariffs being rolled back. Around 60% of American adults invest in the stock market, and the value of their investment and 401(k)s (retirement accounts) will have been substantially impacted by early April’s market sell-off. It would be safe to assume many Americans will have been on the phone to their local Republican representatives to voice their displeasure, and this will ultimately feed back to the White House.

Some Republicans were already looking to save their political capital, with a bipartisan bill coming out that intends to bring tariff power back to Congress. The bill requires Presidents to justify new tariffs and secure congressional approval within 60 days, otherwise they would expire.

Meanwhile the pressure has continued to grow around the President for a reversal on trade policy from those in his inner circle. Elon Musk has called for a rethink, and has continued a feud with Trump’s trade advisor Peter Navarro, who is an ardent supporter of the tariffs. Musk wrote on X that “Navarro is truly a moron.”

The U.S. Trade Representative has meanwhile had to front the Senate Finance Committee at Capitol Hill. Senators drilled down on the intent of the tariffs, with one saying “There is no clear message about how tariffs were determined, what they’re supposed to accomplish, how long they will be in place, whether they’re a negotiating tool or a move to try and cut the United States off from global trade and usher in a new era of 1870s-style protectionism.’’

With all this pressure building (along with the outlook for inflation in the US and another cost-of living shock), it is perhaps no surprise that Trump has recoiled.

The US markets have staged one of the biggest one-day rallies in history on Wednesday as Donald Trump announced a 90-day tariff pause and lowered the baseline on many countries to 10%. The S&P 500 added US$4.3 trillion in market value, reversing most of the decline over the past five trading sessions. With 75 countries having reached out to negotiate, the Trump administration claimed this was “always part of the plan.” The alternative theory is that Trump has buckled to pressure from within his own party, his inner circle, trading partners, corporates, polls, and possibly most significantly, the market meltdown.

Investors weren’t discerning the reasons either way, despite Trump raising the tariffs on imports from China to 125%. The DOW rallied nearly 3000 points, while the S&P 500 leapt 9.5% (the biggest one-day gain since 2008 and the third biggest in post-WWII history) and the Nasdaq soared 12% (the most significant rise since 2001). A record 30 billion shares traded hands. Super-cap tech stocks surged, with Nvidia catapulting 18% higher, and Apple jumping 15%, for its best one-day gain since 2008. Bond yields rose, and commodities jumped - gold rose US$100, copper leapt 7% and oil prices rallied 5%.

A day after claiming that the talk of a pause on tariffs was ‘fake news’ it turns out it is ‘real news.’ During a press conference, Trump said that investors had become too fearful, claiming, “I thought that people were jumping a little bit out of line. They were getting yippy, you know, they were getting a little bit yippy, a little bit afraid.”

Coincidentally earlier in the day the President urged people to ‘be cool’ about four straight days of U.S. stock market declines. He posted on social media three minutes after markets opened in the red that ‘the USA will be bigger and better than ever before” and that “THIS IS A GREAT TIME TO BUY!!!”, not bad timing when you have the inside running.

Only Trump will know to what extent he caved to the pressure, and the reaction to his economic and market vandalism, or whether it was all part of a master plan. Trump said that things were working out faster than he thought. Senator Chuck Schumer posted that the President was ‘feeling the heat’ and had retreated on tariffs because of the ‘Trump Slump.’

In any event, the market reaction was one of huge relief. A 90-day pause also provides much more breathing space for negotiation than the one-month pauses previously offered to Mexico and Canada. This also allows for the quantum of effort required to negotiate a multitude of deals with a multitude of countries.

Other super-cap tech stocks soaring included Amazon which surged 20%, Tesla which jumped 18%, while Meta and Alphabet were both 14% higher. Old economy stocks weren’t left out – Walmart had its best day since 2020, jumping 9.6%, while Goldman Sachs and American Express both surged 12%. Travel companies ripped higher, with United Airlines soaring 26%, American Airlines up 23%, and cruise operator Carnival sailing 18% higher.

The White House said that it will not be releasing a list of the countries that have so far reached out to start negotiating with the U.S. over reciprocal tariffs, but it seems two major partners have been left out of the 90-day pause. There’s no change to Canada and Mexico tariffs, indicating that their levies aren’t going down to the 10% baseline for non-USMCA-compliant goods. The pause does also not apply to sector tariffs.

The ‘chicken run’ with China meanwhile has continued. Trump said that he was raising the tariffs imposed on imports from China to 125% “effective immediately” due to the “lack of respect that China has shown to the World’s Markets.” He added that at some point, hopefully in the near future, China will realise that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable.’

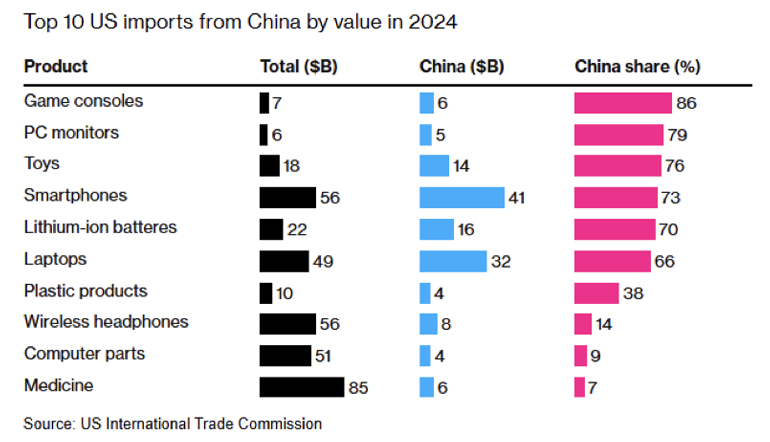

An olive branch of sorts is still there it seems. China has meanwhile increased the tariffs on US goods entering the country to 84% from 34% starting April 10. It will be fascinating to see where China goes from here. Only around 15% of China’s exports go to the US, but the latter is hugely dependent on China for a host of products that can likely be made much cheaper in China. It was interesting that Apple rallied the most since 1998, given it is hugely reliant on China for most of its manufacturing – are markets sensing a meeting between the two superpowers before too long?

n any event, the “inevitable” pause by the Trump administration has provided some much-needed respite for investors – for at least 90 days, if not permanently. Treasury Secretary Scott Bessent said, “The U.S. is going to negotiate in good faith and we assume that our allies will, too.”

Time will tell how those negotiations proceed with each country – Trump has said he wants to be directly involved. However, recessionary risks have also been put on hold for now. Goldman Sachs (which saw a 65% chance of a recession in the next 12 months) and JPMorgan Chase have also followed suit and put their 2025 US recession calls on “pause.”

Investors have also pared back their expectations for Federal Reserve interest rate cuts. The market is now looking for just three reductions this year, assuming quarter-percentage-point increments, according to the CME Group’s FedWatch. This is down from as high as five cuts a few days ago. Trump meanwhile claimed that the bond market, after being very volatile, was “beautiful right now.”

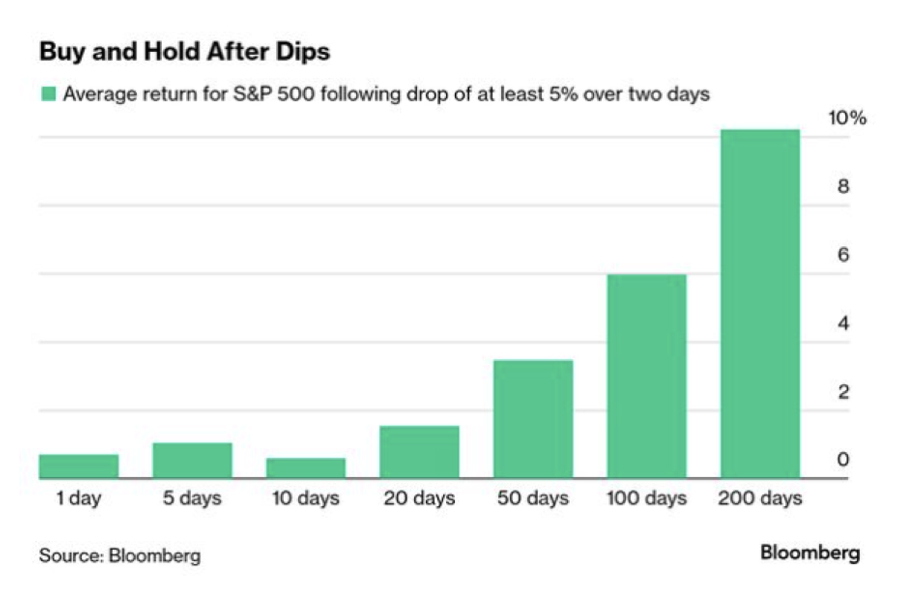

The reaction to the pause also reinforces the need for “cool heads” during the volatility of the past week. The measures unveiled last week were always likely to represent the maximums for those countries willing to engage in negotiations and the worst-case scenarios. Following the rally overnight, the S&P 500 is now just 11% off the record high it reached back in February - it was 19% lower at yesterday’s close. The trade war is not necessarily over but the outlook is brighter than it was.

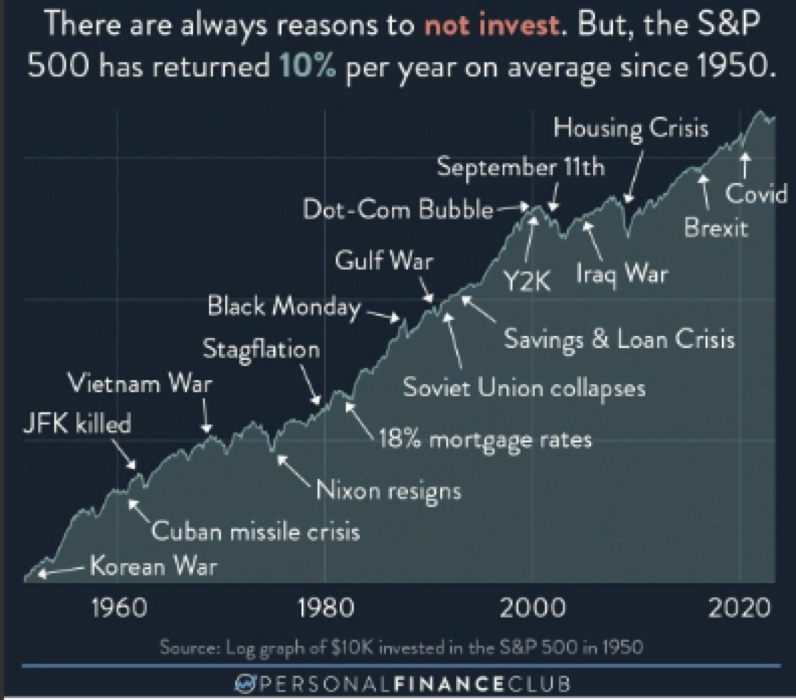

Crisis such as that which was effectively launched by the White House, are not regular, but can and do happen throughout history. The performance of equities through each of these periods continues to provide valuable lessons and a reminder of the importance of holding one’s nerve.

The Kiwi market was down 2.6% last month, and has navigated the recent trade turbulence relatively well. The main name directly exposed to tariffs on the face of it is our biggest exporter, Fisher & Paykel Healthcare. However, it appears the company’s Mexican operations (which supply 60% of US sales) may be exempt as they are largely compliant with the USMCA agreement.

The direct impacts of the tariffs for NZ as a whole seemed relatively contained. There are roughly $9 billion of annual exports to the US, so a 10% tariff is $900 million (a worst-case scenario) which is a very small percentage of GDP if this is a loss of export revenue (i.e. we absorb all the cost). This assumes we still export the same volume to the US. And it also assumes there is no pass through, or any price increase in the US to mitigate the tariff.

In terms of the indirect impacts that is harder to quantify. We are a small open trading economy, and our access to our second biggest export market has been altered (by way of increased costs) and our largest trading partner has been hit with 125% US import tariffs (China). Global trade though is however still reasonably elastic and one assumes that market forces will encourage more profitable and “easier” trade relationships – where that elasticity exists. So we can assume this would increase efforts to find and develop other markets for goods.

The 90-day reprieve for many countries now throws extra attention on China, our largest customer.

Depending on how this all plays out, the repositioning and redirection that occurs as a result could also provide a silver lining for NZ, in addition to some potential deflationary tailwinds.

This would be welcome for a country that already had some good news during the month - the economy has staged a comeback and is out of a technical recession. Gross domestic product rose 0.7% in the December 2024 quarter, following a 1.1% contraction in the September 2024 quarter. Also, something to celebrate is that GDP per capita rose 0.4% during the December 2024 quarter, its first rise in two years.

The market though has also risen in the wake of the tariff pause, and after the RBNZ put through a predictable 0.25% cut to the OCR taking rates 3.5%, the lowest since October 2022.

Most commentators have been congratulating the RBNZ for “holding its nerve” and being “very brave” in going through with just a 0.25% cut on Wednesday. The central bank was always going to want to see “data” but it is clear that significant uncertainties abound.

Officials noted that the recently announced “increases in global trade barriers weaken the outlook for global economic activity. On balance, these developments create downside risks to the outlook for economic activity and inflation in New Zealand.” They added that “as the extent and effect of tariff policies become clearer, the Committee has scope to lower the OCR further as appropriate.”

This is true, although the RBNZ doesn’t now meet until the end of May.

While there is a 90-day pause on the tariff situation, the situation remains fluid, and the reality is that our economy is still only crawling out of a recession, and the neutral OCR is at least 0.5% below where rates sit now.

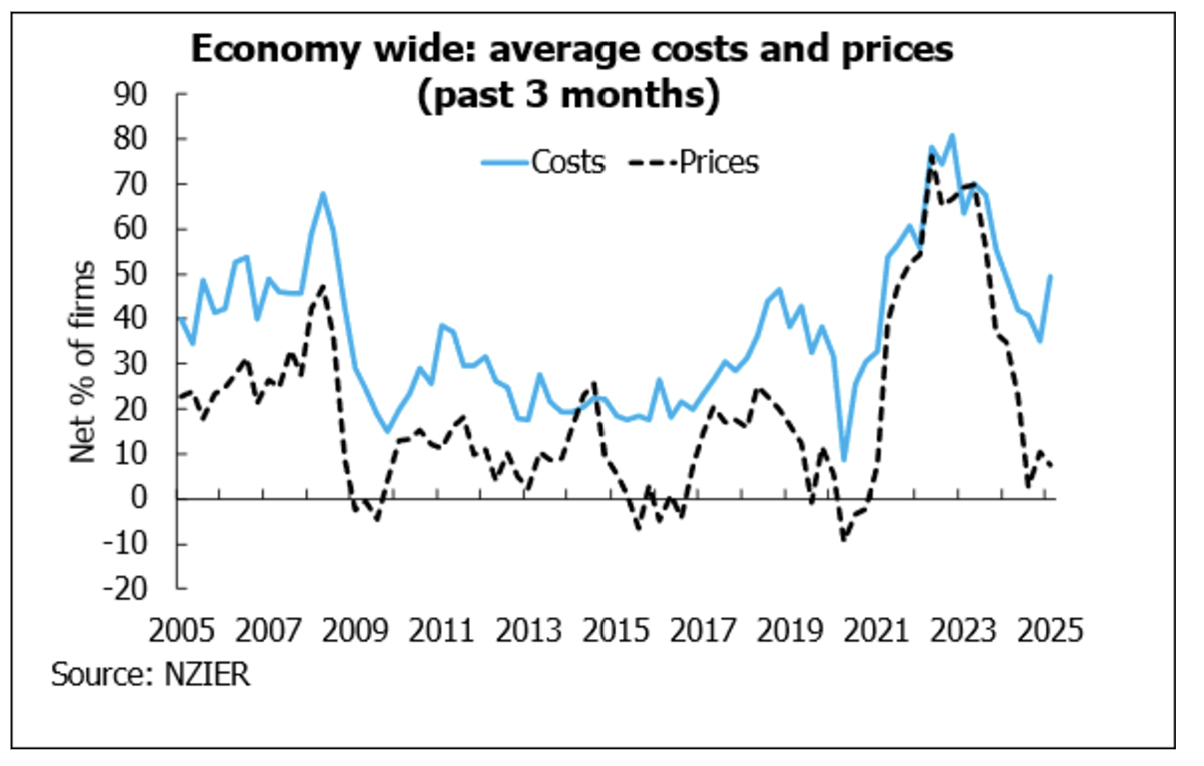

The NZ Institute of Economic Research’s Quarterly Survey of Business Opinion showed that business confidence lifted in the March quarter, but this was largely in response to OCR cuts, and before last week’s announcement in the US. A net 23% of firms expecting general economic conditions to improve over the coming months on a seasonally adjusted basis, up from the net 9% in the previous quarter. Measures of firms’ trading activity however continued to indicate that demand is weak. A net 21% of firms reporting a decline in activity in their own business.

Unemployment is rising and things are going to get worse. The report showed that a a net 17% of firms reduced staff in the March quarter. Firms are planning to reduce investment in buildings, plant and machinery.

Cost pressures remain (the weak currency will be a factor), but the proportion of firms that raised prices in the quarter (8%) is at historic lows. The currency aside, inflationary pressures are continuing to ease against the backdrop of easing capacity pressures.

In the scenario where countries are all cutting tariffs, there will be further deflationary forces at work. Arguably yesterday’s RBNZ decision was a “dovish cut” but perhaps less in the way of mutual “high fives and back-slapping” would be appropriate given where our economy is at.

In any event the past week or so has provided a valuable reminder for investors.

Such severe market sell-offs, while not regular, have been seen before, and have occurred throughout history. There was the GFC and more recently during the pandemic when panic set in with the arrival of Covid-19. The lessons from those shocks, and to paraphrase Kipling, is that it is all about “keeping one’s head” when others are losing theirs. The worst time to sell is when fear is ruling the market, as was seen during the severe, but brief, drop during the Covid meltdown, which preceded a multi-year bull market run. The S&P500 rallied 70% in the year following the “Covid crash.”

The backflip by Trump is not surprising, and also as he can claim that it was all part of his master plan. Ironically the country that will be most negatively impacted by a full-blown trade war would be the US itself, and political pressure was always going to come to bear on the Trump administration. The increasing emergence of trade negotiations, compelled by the interests of economic and political preservation, were always going to be a key stabilising factor for markets this time around. Now however it is all about the main event – US vs China.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Harbour Outlook: Escalating trade tensions impact markets |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |