SPIRITWOOD, N.D.-New Energy Blue LLC is about five months away from finishing engineering and permitting on a $150 million plant project that would turn wheat and corn field residue into ethanol for high-end renewable markets.

If everything goes perfectly, a plant could open in 2021, says Thomas G. Corle, the company's chief executive officer. The Spiritwood plant would produce about 16 million gallons per year of cellulosic ethanol.The company hopes to market the fuel mostly into the California market that pays for reduced-carbon fuel.

New Energy Blue was established three years ago and is incorporated in Delaware. They have an office in Boston and one in Denmark.

If completed as envisioned, the plant would produce about $110 million in revenue annually. The project boasts $40 million to $50 million of EBITDA, an accounting measure indicates a company's ability to generate cash flow for owners.

Ramping up

ADVERTISEMENT

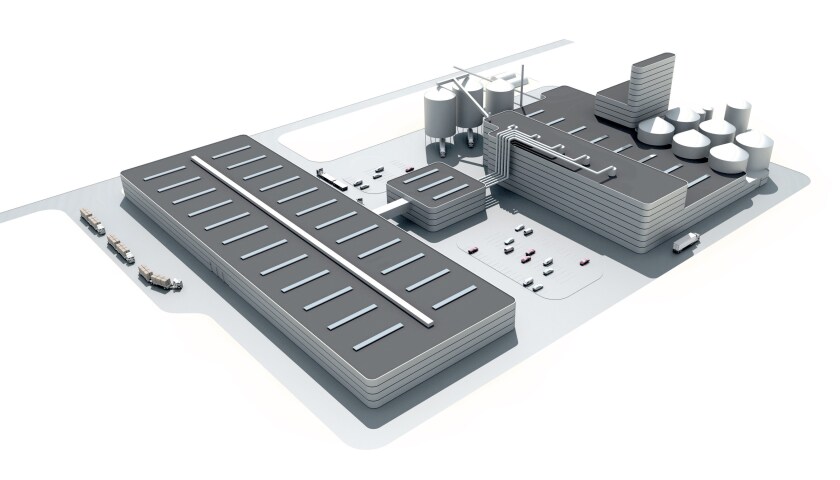

New Energy Blue expects to build near the Spirit AgEnergy corn-ethanol plant. The company would build a ramp over the rail loop for trucks to drive inside. The plan has it occupying about 30 acres of the 200 acres inside the rail loop and would share rail capacity and ethanol load-out with the existing corn ethanol plant.

One of the pluses for marketing is that the project doesn't use any fresh water in its process, which is a valuable plus for the environment. The process uses high-pressure steam to break down the biomass, without the dilute acids or ammonias.

New Energy Blue is working through a firm in New York City to issue renewable bonds at the end of their development period. North Dakota has $300 million in tax-free renewable municipal bonds that could be used for projects that turn a "waste material," in this case residue, to a "special need renewable product," such as fuel and power, he says.

Corle says large asset buyers such as Black Rock, Vanguard Group and Fidelity Investments, could buy up these bonds. "They're in a very special need right now for projects like ours," Corle says. "They like to buy these bonds that have operating assets that can give long-term returns to them."

"These bonds can be rated at a near AAA-rated bond," he says, meaning it is highly credit-worthy and can easily meet its financial commitments. The government of Denmark is also providing a loan guarantee for the project.

A 2.5% premium

If the figures hold true, New Energy Blue figures it can add 2.5 percent more income than it can receive from marketing corn through an ethanol plant. "Some of the largest farmers in North Dakota have invested into the project," Corle says. Some have provided "early capital" to develop the project, with an intent to deliver biomass later.

ADVERTISEMENT

Mark Watne, president of the North Dakota Farmers Union, says he's made his facilities and members available to learn about how the New Energy Blue might fit into their farming operations. He thinks it might have potential for farmers up to 150 miles away from the plant to make some money and still keep enough residue on the land to keep organic matter healthy. He says the difference between this project and prior projects is an increase in ethanol markets if the nation moves from 10 percent ethanol blends to 15 percent, and because of the enzymes this company is using.

New Energy Blue will have a signed contract with Pacific Ag, Hermiston, Ore., a company active in the Red River Valley since 2016. Tom Borgen of Georgetown, Minn., is general manager and sales manager.

Pacific Ag, which bills itself as the "nation's largest provider of comprehensive agricultural biomass supply chain solutions," would harvest and deliver the 240,000 tons of wheat straw biomass needed for the Spiritwood plant. "We've been working with them for awhile and they will guarantee that delivery to our site," he says.

New Energy Blue is expecting to pay about $30 per ton for biomass, harvested, baled and located at the side of a field, Corle says. He expects about $15 million in annual revenue and the aggregator every year. The plant expects to pull in about 30 percent of the biomass in less than a 50-mile radius of the plant. The company expects to repeat the project with others that will be about twice the size, with an annual investment of biomass of $30 million.

30% equity

Through the bond market, they're planning to finance the project with 30 percent equity and 70 percent debt financing, and "show very high returns on that equity," Corle says.

The U.S. Renewable Fuel Standard mandates the country use 16 billion gallons of "advanced ethanol." There isn't enough cellulosic ethanol today to meet that requirement. The company would also get paid on carbon saved. "A lot of grain ethanol plants can't go into these low-carbon fuel markets, simply because their carbon score is too high," Corle says. Canada's transportation sector is about the same size market as California, which is rolling out a similar low carbon fuel standard.

ADVERTISEMENT

Corle he's cheered that the Trump administration is favoring policies that over the two years could increase ethanol blends from a typical 10 percent to 15 percent or E15.

That could spur some grain ethanol expansion, Corle says, adding, "Certainly it helps accelerate what we're doing on the cellulosic side, with the ramp-up to the gallons on the market," Corle says.

Lignin and Btus

Besides, ethanol, the factory would also produce 110,000 tons of lignin-an organic polymer found in the rigid cell walls of plants. The product would be shipped to Europe to meet mandates there for cutting carbon emissions in producing electricity,

Lignin is "very high in tensile strength," Corle says, noting it has about the same amount energy (British thermal units) as a high-quality coal.

The proposed plant would process 33 tons per hour of biomass-wheat straw, with "campaigns" of corn stover and barley straw. Energy Blue will produce its own steam from its waste material.

"We will be working with (Dakota Spirit AgEnergy) which will have a management and operations agreement with our facility, with shared facilities there," Corle says, referring to the 70 million gallon per year corn ethanol plant, next door.

"While Midwest AgEnergy is supportive of value-added industries that benefit our North Dakota producers, my client has not entered any management or operations agreements with New Energy Blue, LLC and to state they intend to do so would be very premature at this point," says Alison Ritter, a public relations specialist for Odney Advertising, which represents Midwest AgEnergy and its Dakota Spirit plant.

ADVERTISEMENT

Grain ethanol produces 20 to 30 percent less carbon than gasoline. "Ours can run as much as 130 percent below the baseline," Corle says. It's the difference between basing the ethanol off of grain residue versus starch-based grain content. A lower score means the fuel will receive a premium of 60 cents to $2 a gallon, in California.

Ethanol veteran

Corle, who lives near Lancaster, Pa., jokingly describes himself as "one of the longest-living guys in the ethanol industry." He has been in the ethanol industry for 22 years.

His first project was the Chippewa Valley Ethanol Co. of Benson, Minn., in the late 1990s. He worked for then-Delta T Corp.of Williamsburg, Va., an ethanol process technology company. He worked with ICM, Inc., of Colwich, Kan., which provided dryers and Fagen Inc., Granite Falls, Minn., on the project. Delta-T in Corle's time went from 20 engineers to about 800 engineers. In 2008, grain ethanol construction hit a market ceiling as the stock market deflated and the economy slowed.

Corle became connected to Dalton Energy, the largest energy company in Denmark, was building a demonstration plant for turning Danish wheat straw to ethanol. Delta T took a process engineering firm to Denmark.

"They advanced that technology and process to a point where they were running about 2 million gallons a year, from that Danish wheat straw," he says. "We also sent over a lot of Midwestern corn stover to Denmark and did a not of testing," he says.

In about 2015 Royal DSM of the Netherlands had a breakthrough, Corle says. The Danes modified a yeast to more completely ferment the sugars.allowing for a 40 percent increase processing of product from that ton of biomass."

Corle recently acquired exclusive rights to that technology for North America and South America. The goal is to use wheat straw, corn stover, sugar bagasse-a lot of waste products to ethanol production. "Today we're able to show very high, double-digit returns on equity on projects and that's why this product is moving forward," he says.

ADVERTISEMENT