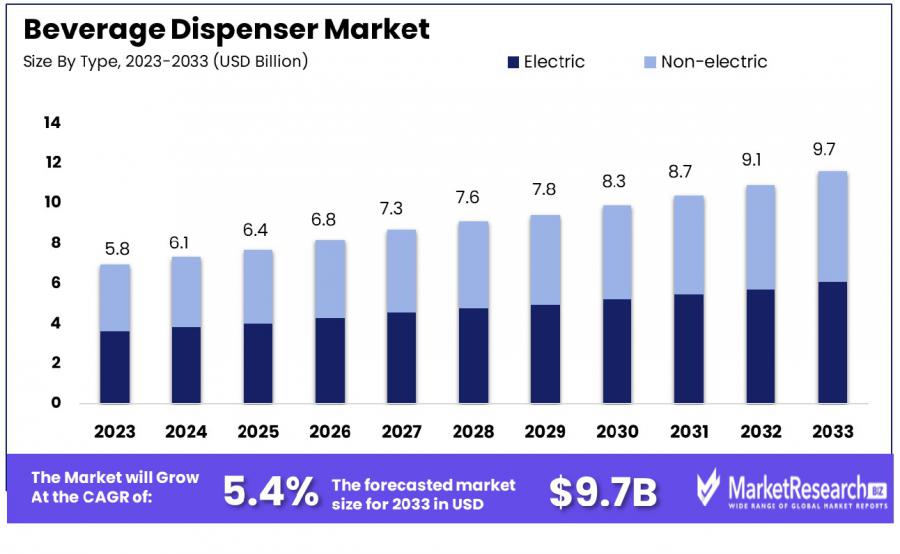

Beverage Dispenser Market Size to Hit USD 9.7 Billion by 2033, Expanding at a 5.4% CAGR

Beverage Dispenser Market, valued at USD 5.8 Bn in 2023, is projected to reach USD 9.7 Bn by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

NEW YORK, NY, UNITED STATES, January 22, 2025 /EINPresswire.com/ -- Report Overview

The Global Beverage Dispenser Market was valued at USD 5.8 billion in 2023 and is projected to reach USD 9.7 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

A beverage dispenser is a device designed to efficiently serve a variety of beverages, ranging from soft drinks and juices to coffee and alcoholic beverages. These dispensers are commonly used in both commercial settings, such as restaurants, hotels, and events, as well as in homes for convenience and ease of use. Beverage dispensers are often equipped with features like adjustable temperature controls, serving sizes, and multi-product dispensing capabilities, ensuring user-friendly functionality and consistent beverage quality.

The beverage dispenser market refers to the commercial and residential sectors that utilize these devices to deliver beverages quickly and efficiently. This market encompasses various types of dispensers, including countertop units, freestanding machines, and sophisticated vending solutions. The market has witnessed a steady demand due to the growing trend of convenience-driven consumer behavior and the increasing need for automation in foodservice operations. Additionally, advancements in technology, such as smart dispensers with touch-screen interfaces and integration with mobile apps, have further fueled market growth.

Several factors are driving the growth of the beverage dispenser market. Rising disposable incomes, changing consumer preferences for quick and on-demand beverage services, and the expanding foodservice industry are key contributors. Furthermore, increasing awareness about sustainability has led to innovations in eco-friendly designs, reducing waste and promoting reusable components.

Request a Detailed Sample Report and Discover Key Insights at https://marketresearch.biz/report/beverage-dispenser-market/request-sample/

Opportunities within the market lie in the customization of dispensers for specific beverage types, the integration of health-conscious options like low-sugar or plant-based drinks, and the development of intelligent dispensers that optimize operational efficiency in commercial settings. These trends indicate a promising growth trajectory for the beverage dispenser market in the coming years.

**Key Takeaways**

~~ Global Beverage Dispenser Market Size Valued at USD 5.8 billion in 2023, the market is projected to reach USD 9.7 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

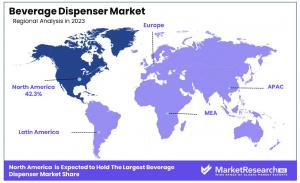

~~ North America dominates the global beverage dispenser market with a share of 42.3%.

~~ Electric beverage dispensers account for the largest market share at 80.2%, reflecting the growing preference for automated, energy-efficient solutions.

~~ Beverage dispensers with a capacity of under 5 liters hold the dominant market share at 44.3%.

~~ Plastic beverage dispensers lead the market, comprising 56.2% of the total market share due to their cost-effectiveness and durability.

~~ Residential applications are the largest segment, capturing 35.3% of the market, driven by increasing demand for home-use dispensers.

~~ The online retail channel is the leading distribution method, accounting for 25.2% of the market, as consumers increasingly prefer the convenience of e-commerce.

** Regional Analysis**

North America Beverage Dispenser Market with Largest Market Share (42.3%) in 2023

The Beverage Dispenser Market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds a dominant share of the market, accounting for 42.3% of the global market in 2023. The region's growth is driven by high consumer demand for beverage dispensing solutions across various sectors, including restaurants, bars, and large-scale food service operations, combined with the rapid technological advancements in dispenser systems. The market in North America is projected to continue its strong growth trajectory, benefiting from increased automation and sustainability trends.

In Europe, the market is expected to experience steady growth, fueled by the rising demand for energy-efficient and eco-friendly beverage dispensing solutions. The European market is characterized by a high degree of competition among local and international players, particularly in countries like Germany, France, and the UK, which are at the forefront of technological innovations in the foodservice industry.

The Asia Pacific region is forecast to witness the fastest growth over the coming years, driven by the rapidly expanding foodservice industry in countries like China, India, and Japan. Rising urbanization, a growing middle-class population, and increased disposable income are major factors propelling the demand for beverage dispensers in this region. The region's market growth is further supported by the increasing adoption of beverage dispensers in quick-service restaurants (QSRs) and commercial establishments.

In Latin America, while the market is relatively smaller compared to North America and Europe, it is expected to show moderate growth due to the increasing adoption of modern foodservice equipment. Brazil and Mexico are the leading countries in this region, where urbanization and the growing food and beverage industry drive the demand for innovative beverage dispensers.

The Middle East & Africa market remains niche but is growing steadily, primarily driven by the increasing presence of international fast-food chains and hotels in countries like the UAE and Saudi Arabia. The region's growth is also supported by increasing tourism and a preference for self-service beverage dispensers in commercial establishments. However, regional infrastructure limitations may impact faster adoption.

** Market Segmentation**

By Type Analysis

In 2023, electric beverage dispensers dominated the market with an 80.2% share, driven by their convenience, efficiency, and ability to handle high volumes across sectors like food services, hospitality, and corporate environments. These dispensers offer automated, energy-efficient solutions with consistent service. The non-electric segment, although smaller, holds a niche role in markets prioritizing portability and lower costs, such as outdoor events and small eateries. This segment continues to be relevant for its simplicity and cost-effectiveness. Technological advancements in electric dispensers, alongside growing environmental concerns, are boosting demand for energy-efficient and eco-friendly models. Investments in R&D will likely sustain electric dispenser growth, while the non-electric segment may see innovation focused on enhancing usability and reducing reliance on electricity.

By Capacity Analysis

In 2023, beverage dispensers with a capacity of less than 5 liters led the market, holding a 44.3% share. This dominance is due to the growing demand for compact dispensers in smaller settings like cafes, private offices, and boutique establishments, where space-saving and ease of maintenance are key.The 5 to 10 liters segment, catering to medium to large venues such as restaurants and hotels, also holds a significant share, balancing volume with convenience. Dispensers over 10 liters are used in high-volume environments like large events and fast-food outlets, where efficiency is critical, though they represent a smaller portion of the market. Technological innovations, including automated refilling and integrated cleaning features, are driving growth across all segments, with increasing demand for energy-efficient and eco-friendly solutions in response to sustainability trends.

By Material Type Analysis

In 2023, plastic beverage dispensers dominated the market, capturing 56.2% of the "By Material Type" segment due to their affordability, lightweight nature, and versatility. Glass dispensers, though holding a smaller share, are preferred in high-end settings for their aesthetic appeal. Stainless steel dispensers are valued for durability and hygiene, particularly in heavy-duty environments. The "Others" category, featuring eco-friendly materials, is growing as sustainability concerns rise. Future market trends may see increased demand for recyclable and eco-friendly materials

By Application Analysis

In 2023, the residential segment dominated the Beverage Dispenser Market, holding 35.3% of the share. This growth is driven by the rising demand for home entertainment and convenience products for at-home dining and socializing. Sophisticated, user-friendly dispensers designed for kitchens and outdoor spaces have further fueled this trend. The commercial segment, catering to restaurants, cafes, offices, and hospitality venues, also holds a significant market share. These dispensers are designed for high-volume use and emphasize efficiency, speed, and reliability. Both segments are being shaped by technological innovations such as touch-free dispensing, temperature control, and smart features. Sustainability is also a key trend, with consumers prioritizing energy-efficient and eco-friendly products. Future developments will focus on enhanced connectivity and smart functionalities, benefiting both residential and commercial markets.

By Distribution Channel Analysis

In 2023, online retail dominated the Beverage Dispenser Market, capturing 25.2% of the share, driven by consumer preferences for the convenience, variety, and competitive pricing of e-commerce platforms. Supermarkets followed closely, offering physical inspection and immediate purchase options. Specialty stores focused on high-quality, often commercial-grade dispensers, while convenience stores catered to small-scale, impulse buyers. The "Others" category, which includes direct sales and niche outlets, represents smaller market segments. As e-commerce continues to grow, other channels will adapt to complement its reach and convenience.

Purchase the Market Report Now and Save Up to 30% at https://marketresearch.biz/purchase-report/?report_id=10051

** Key Market Segments**

By Type

~~ Electric

~~ Non-electric

By Capacity

~~ Less than 5 liters

~~ 5 to 10 liters

~~ More than 10 liters

By Material Type

~~ Plastic beverage dispensers

~~ Glass beverage dispensers

~~ Stainless steel beverage dispensers

~~ Others

By Application

~~ Residential

~~ Commercial

By Distribution Channel

~~ Online retail

~~ Supermarkets

~~ Specialty stores

~~ Convenience stores

~~ Others

** Emerging Trends**

~~ Smart and Connected Dispensers: With technological advancements, smart beverage dispensers are gaining popularity. These systems allow businesses to remotely monitor and control beverage levels, optimize stock management, and ensure consistent quality. These dispensers often feature touchless interfaces and integrate with mobile apps for real-time updates.

~~ Sustainability Focus: There is an increasing shift toward eco-friendly beverage dispensers that reduce waste. Brands are designing dispensers that minimize the use of disposable cups and packaging. These systems are being adopted in both commercial and residential settings to promote sustainability.

~~ Customization and Personalization: Beverage dispensers are increasingly being designed with customizable options for consumers. From adjusting the temperature of drinks to selecting unique flavor combinations, consumers now expect a personalized beverage experience. This trend is especially prominent in high-traffic commercial settings, such as cafes, restaurants, and quick-service restaurants (QSRs).

** Top Use Cases**

~~ Foodservice Industry: Beverage dispensers are widely used in cafes, restaurants, and fast food chains for quick, efficient beverage serving. They allow businesses to offer a variety of drinks with minimal labor input, ensuring a high level of customer satisfaction.

~~ Self-Serve Locations: Vending machines and self-service kiosks in public spaces, airports, and malls are growing in popularity. These dispensers cater to consumers who want a fast and convenient way to access beverages without requiring staff intervention.

~~ Event and Hospitality Sector: Beverage dispensers are also in high demand for large events, catering services, and hotels. They are used to serve drinks in high volumes during conferences, festivals, and banquets, ensuring smooth service and reducing wait times for guests.

** Major Challenges**

~~ High Initial Investment: Beverage dispensers, especially those that are technologically advanced, come with a high upfront cost. Smaller businesses or startups may find it difficult to afford advanced models with integrated features like smart connectivity or customization options.

~~ Maintenance Costs: Regular maintenance of beverage dispensers is required to ensure that the machines function optimally. This adds to the overall cost, as businesses need to schedule routine check-ups, cleanings, and occasional repairs, which can be costly and time-consuming.

~~ Space and Installation Constraints: In certain commercial environments, space is limited, which may restrict the adoption of large beverage dispensers. Additionally, installation may require specific plumbing or electrical setups, creating logistical challenges for businesses in terms of retrofitting existing spaces.

**Top Opportunities**

~~ Adoption in Emerging Markets: Emerging economies, particularly in Asia Pacific and Latin America, present significant growth opportunities. The growing urbanization and rising disposable income in these regions are driving the demand for advanced beverage dispensers, especially in the foodservice sector.

~~ Growth of the QSR Industry: Quick-service restaurants are increasingly adopting beverage dispensers to streamline their operations and cater to the growing consumer demand for fast, high-quality beverages. As the QSR industry continues to grow, there is an expanding market for dispensers capable of delivering drinks efficiently and at scale.

~~ Technological Integration: The integration of artificial intelligence (AI) and the Internet of Things (IoT) into beverage dispensers is a major opportunity. These technologies can help businesses better manage their operations by providing insights into consumer preferences, inventory levels, and even predictive maintenance needs.

Explore Custom Research Solutions Before You Buy the Report

**Key Players Analysis**

The Global Beverage Dispenser Market in 2024 is shaped by a competitive landscape featuring key players that dominate across diverse sectors, from commercial foodservice to convenience-based solutions. Cornelius, Inc., and Lancer Corporation are prominent for their innovative beverage dispensing technologies, offering a wide array of systems tailored to high-volume applications. Similarly, Grindmaster-Cecilware, Inc. and Cambro Manufacturing Co. have established themselves as leaders in providing reliable, cost-effective dispensers that cater to both hot and cold beverages. Manitowoc Foodservice, Inc. (now part of Welbilt) has continued to evolve with advanced ice-making and beverage dispensing solutions, meeting the demands for energy efficiency and ease of use. FBD Frozen Beverage Dispensers and Follett LLC focus on niche markets, excelling in frozen beverage solutions and ice-cold dispensing systems. BUNN-O-Matic Corporation is known for its high-quality commercial coffee dispensers, while Hoshizaki America, Inc. is recognized for its comprehensive beverage systems. Multiplex Beverage stands out with modular dispensing solutions, catering to diverse foodservice needs globally. These players remain instrumental in driving innovation and market expansion as consumer preferences for speed, convenience, and versatility continue to evolve.

Market Key Players

~~ Cornelius, Inc.

~~ Lancer Corporation

~~ Grindmaster-Cecilware, Inc.

~~ Cambro Manufacturing Co.

~~ Manitowoc Foodservice, Inc

~~ FBD Frozen Beverage Dispensers

~~ Follett LLC

~~ BUNN-O-Matic Corporation

~~ Hoshizaki America, Inc.

~~ Multiplex Beverage.

Conclusion

The global beverage dispenser market is poised for steady growth, with a projected value of USD 9.7 billion by 2033, driven by increasing consumer demand for convenience, technological advancements, and sustainability trends. North America leads the market, while the Asia Pacific region is expected to experience the fastest growth due to expanding foodservice industries and rising urbanization. Key drivers include the growing preference for automated, energy-efficient solutions and the rise of smart dispensers. While challenges such as high initial investment and maintenance costs persist, significant opportunities lie in emerging markets, the growth of the quick-service restaurant sector, and the integration of advanced technologies like AI and IoT. The market remains competitive, with major players continuously innovating to meet evolving consumer preferences.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Consumer Goods

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release