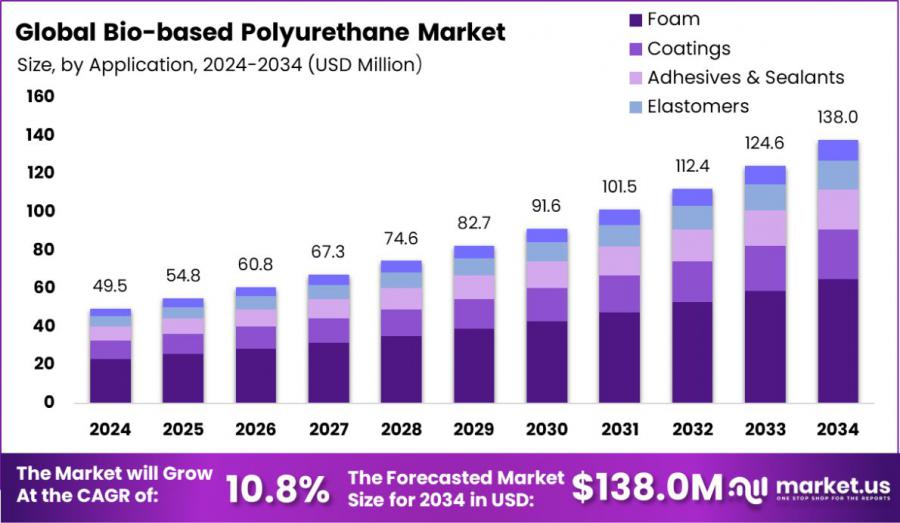

Bio-based Polyurethane Market to Reach USD 138.0 Mn by 2034, Driven by a 10.8% CAGR from 2025-2034

Bio-based Polyurethane Market size is expected to be worth around USD 138.0 Mn by 2034, from USD 49.5 Mn in 2024, CAGR of 10.8% forecast period 2025 to 2034

NEW YORK, NY, UNITED STATES, January 24, 2025 /EINPresswire.com/ -- Report Overview

Bio-based polyurethane is a type of polyurethane derived from renewable biological resources rather than traditional petroleum-based ingredients. These polyurethanes use plant-based polyols such as those derived from vegetable oils or starches, which are then reacted with isocyanates to form the polyurethane.

The use of renewable resources makes bio-based polyurethanes more sustainable and environmentally friendly compared to their conventional counterparts. They offer similar, and sometimes superior, properties such as durability, flexibility, and resistance to wear and tear, making them suitable for a wide range of applications including foams, coatings, adhesives, and elastomers.

The bio-based polyurethane market refers to the commercial sector involved in the production, distribution, and sale of polyurethane products manufactured using bio-based materials. This market is driven by increasing environmental concerns and regulatory pressures to reduce carbon footprints and dependence on fossil fuels.

Industries such as automotive, furniture, footwear, and textiles are major consumers of bio-based polyurethanes, seeking to incorporate more sustainable materials into their products. The market is also supported by technological advancements in bio-based materials and growing consumer preference for eco-friendly products.

One significant growth factor for the bio-based polyurethane market is the rising demand for sustainable and green building materials. With an increasing global focus on energy efficiency and reduced environmental impact, construction, and architectural sectors are increasingly adopting bio-based polyurethanes for insulation, sealants, and flooring applications. This shift is supported by government incentives and stringent regulations aimed at promoting sustainable construction practices.

The demand for bio-based polyurethanes is primarily driven by the automotive industry's shift towards more sustainable materials. As automakers strive to reduce the environmental impact of their vehicles, bio-based polyurethanes are being used more extensively in car interiors for seats, dashboards, and headliners. This transition is not only driven by environmental regulations but also by consumer preferences for vehicles made with eco-friendly materials.

There are substantial opportunities in the development of new bio-based formulations that offer enhanced properties such as increased heat resistance and mechanical strength. Innovations in biochemical processes that allow for the use of non-food biomass as feedstock can further expand the market. Additionally, expanding applications in sectors like medical devices and consumer goods, where biocompatibility and sustainability are increasingly valued, present lucrative opportunities for market expansion.

Regulatory policies and environmental governance are key driving factors for the bio-based polyurethane market. Governments worldwide are enacting stricter regulations on VOC emissions and waste reduction, which encourage manufacturers to adopt bio-based alternatives. Additionally, corporate sustainability goals across various industries propel the adoption of bio-based materials, as companies aim to improve their environmental image and meet consumer expectations for sustainability.

Get a Sample PDF Report: https://market.us/report/bio-based-polyurethane-market/request-sample/

Key Takeaway

• Bio-based Polyurethane Market size is expected to be worth around USD 138.0 Mn by 2034, from USD 49.5 Mn in 2024, CAGR of 10.8% during the forecast period 2025 to 2034.

• In 2024, foam dominated the bio-based polyurethane market, holding over 47.10% share, favored in automotive, construction, and furniture for its sustainability.

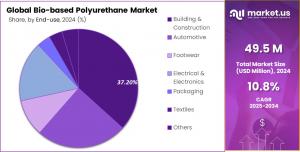

• In 2024, the Building & Construction sector led the bio-based polyurethane market with over a 37.20% share, primarily for insulation and sealants due to the push for sustainable building practices.

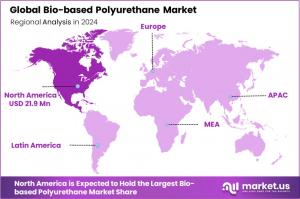

• In 2024, North America emerged as the leading region in the bio-based polyurethane market, accounting for 44.40% of the global market share with a value of USD 21.9 billion.

Bio-based Polyurethane Market Segment Analysis

By Application Analysis

In 2024, foam dominated the bio-based polyurethane market, holding over 47.10% share, favored in automotive, construction, and furniture for its sustainability. Rigid foams are growing in demand due to energy efficiency needs, while bio-based polyurethane coatings, adhesives, and elastomers are increasingly used across various industries for their environmental benefits and performance, making significant contributions to sustainable manufacturing practices.

By End-use Analysis

In 2024, the Building & Construction sector led the bio-based polyurethane market with over a 37.20% share, primarily for insulation and sealants due to the push for sustainable building practices. Other key sectors include Automotive, using these materials for lighter, more fuel-efficient vehicles, and Footwear, for durable, eco-friendly components. Electrical & Electronics, along with Packaging and Textiles, also significantly contribute to the market, driven by a universal shift towards sustainability.

Buy Now: https://market.us/purchase-report/?report_id=18231

Key Market Segments

By Application

• Foam

— Rigid

— Flexible

• Coatings

• Adhesives & Sealants

• Elastomers

• Others

By End-use

• Building & Construction

• Automotive

• Footwear

• Electrical & Electronics

• Packaging

• Textiles

• Others

Top Emerging Trends

1. Green Building Compliance Surge: The bio-based polyurethane market is riding a wave of growth, propelled by escalating regulations for green building compliance. As global standards for energy efficiency and reduced emissions tighten, the adoption of bio-based polyurethanes in construction materials is rapidly increasing. These materials are integral in achieving sustainability certifications for buildings, making them highly sought after by developers and contractors aiming to meet or exceed environmental norms.

2. Automotive Lightweighting Initiatives: In the automotive sector, the push towards lighter vehicles to enhance fuel efficiency and reduce emissions continues to drive demand for bio-based polyurethanes. These materials are crucial in manufacturing lighter and more sustainable car components such as seats, dashboards, and interior panels. This trend is aligned with the automotive industry’s broader shift towards sustainability and regulatory compliance on environmental impacts.

3. Advancements in Bio-Polyol Techniques: Technological advancements in the production of bio-polyols—the critical component derived from natural oils and sugars in bio-based polyurethanes—are setting a brisk pace. Improved techniques for synthesizing bio-polyols are enhancing the efficiency and reducing the cost of production, making bio-based polyurethanes more competitive with their fossil-fuel-based counterparts and expanding their application across diverse industries.

4. Expansion into Niche Markets: Bio-based polyurethanes are increasingly finding applications in niche markets such as medical devices, sports equipment, and children's toys. These sectors value the environmental safety and biocompatibility that bio-based materials offer. This expansion is spurred by consumer preferences shifting towards products that are safe and sustainable, opening new avenues for growth in specialized markets.

5. Sustainable Packaging Solutions: With a growing emphasis on sustainability in the packaging industry, bio-based polyurethanes are becoming a popular choice for eco-friendly packaging solutions. They are used to produce both rigid and flexible foams that provide excellent cushioning properties and durability, while also being biodegradable or recyclable. This trend is driven by consumer demand for sustainable packaging and corporate commitments to reducing environmental footprints.

Regulations on Bio-based Polyurethane Market

Bio-based polyurethanes (PUs) are gaining attention as sustainable alternatives to traditional petroleum-based PUs, driven by environmental concerns and regulatory pressures. In 2016, PUs accounted for approximately 8% of global plastics production, ranking as the sixth most utilized polymer worldwide. The global PU market was projected to reach USD 88 million by 2026, with a compound annual growth rate of 6%.

The shift towards bio-based PUs is influenced by the need to reduce reliance on non-renewable resources and to mitigate environmental impacts. Bio-based PUs are derived from renewable sources such as vegetable oils, lignin, and other biomass materials, offering advantages in terms of biodegradability and reduced greenhouse gas emissions.

Regulatory frameworks worldwide are increasingly promoting the use of sustainable materials. For instance, the European Union's policies encourage the adoption of bio-based products to achieve environmental sustainability goals. Similarly, various countries are implementing regulations to reduce carbon footprints, thereby fostering the development and use of bio-based PUs.

Regional Analysis

The bio-based polyurethane market exhibits distinct dynamics across various regions due to differing industrial applications, regulatory environments, and technological advancements.

In North America, the market dominates with a share of 44.40%, amounting to USD 21.9 billion, driven by robust demand in the automotive and construction sectors that prioritize sustainable materials.

Europe follows closely, leveraging stringent environmental regulations that favor bio-based alternatives, fostering significant growth in furniture and textile applications. The Asia Pacific region is witnessing rapid expansion, attributed to escalating industrial activities and rising environmental awareness, especially in China and India. This region benefits from both governmental support for green chemicals and a vast consumer base shifting towards eco-friendly products.

The Middle East & Africa, though smaller in comparison, show potential due to developing infrastructure and an increasing focus on sustainable materials, particularly in oil-rich economies aiming for industrial diversification.

Lastly, Latin America, with its burgeoning manufacturing sector and favorable agricultural conditions for bio-based feedstock, is gradually adopting bio-based polyurethanes, notably in the automotive and packaging industries. Overall, these regional trends underscore a global shift towards sustainability, with North America leading the charge.

Key Players Analysis

◘ BASF SE

◘ Covestro AG

◘ Cargill, Incorporated

◘ Huntsman International LLC

◘ The Lubrizol Corporation

◘ MITSUI & CO., LTD.

◘ Arkema

◘ Miracll Chemicals Co. Ltd

◘ Stahl Holdings BV

◘ Rampf Group

◘ Epaflex

◘ MCPU Polymer Engineering

◘ Other Key Players

Recent Developments of Bio-based Polyurethane Market

— In October 2024, Abu Dhabi's ADNOC announced plans to acquire Covestro AG for €14.7 billion, aiming to strengthen its position in the chemical industry.

— In 2022, BASF reported €87.3 billion in revenue in 2022. Also in 2023-24, it expanded partnerships with Cargill for enzyme solutions and Lubrizol for industrial lubricants, strengthening its position in specialty chemicals and coatings.

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release