Marine Omega-3 Market To Reach USD 15.4 Bn by 2034 at 5.3% CAGR

Marine Omega-3 Market is expected to be worth around USD 15.4 Billion by 2034, up from USD 9.2 Billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034.

NEW YORK, NY, UNITED STATES, January 28, 2025 /EINPresswire.com/ -- Report Overview

The Global Marine Omega-3 Market is projected to experience significant growth, expanding from a valuation of USD 9.2 billion in 2024 to an estimated USD 15.4 billion by 2034. This growth trajectory reflects a steady compound annual growth rate (CAGR) of 5.3% during the forecast period from 2025 to 2034.

Such an upward trend underscores the robust dynamics of the marine omega-3 industry and highlights its critical role in the broader nutraceutical and functional foods sector. Marine omega-3 fatty acids, primarily found in fish oil and algae, play a pivotal role in human health, contributing to cardiovascular, cognitive, and joint health, among other benefits. This has led to their increased incorporation in a variety of dietary supplements and functional foods.

The industrial scenario for marine omega-3s is evolving, driven by advancements in extraction and processing technologies that have enhanced the purity and efficacy of these fatty acids. Moreover, the market is witnessing a shift towards sustainable sourcing practices, given the ecological concerns associated with overfishing and the environmental impact of traditional fish farming. This shift is facilitated by the development of high-yield algae-based omega-3 sources, which are gaining traction as a viable and sustainable alternative to fish-based omega-3s.

Several factors are propelling the growth of the Global Marine Omega-3 Market. Firstly, there is an increasing consumer awareness regarding the health benefits associated with omega-3 consumption, supported by scientific research linking omega-3 intake with reduced risk of chronic diseases such as heart disease, arthritis, and depression. This awareness is complemented by the aging global population, particularly in developed nations, where there is a heightened focus on wellness and preventative healthcare. Additionally, regulatory support for functional foods and dietary supplements in regions such as North America, Europe, and parts of Asia-Pacific further boosts the market expansion.

The market's growth is also being driven by innovations in product development and formulation. Manufacturers are increasingly focusing on producing high-concentration, pharmaceutical-grade omega-3 products that offer higher efficacy with smaller dosages, catering to consumer preferences for convenience and efficacy. Furthermore, the integration of omega-3 into various food and beverage products, such as dairy products, infant formula, and bakery goods, is expanding the reach of omega-3-enriched products to a wider audience.

Looking ahead, the future growth opportunities in the Global Marine Omega-3 Market are substantial. The ongoing research into the role of omega-3 fatty acids in mental health, eye health, and even in the management of autoimmune diseases promises to open new application avenues for these nutrients. Additionally, the market is likely to benefit from the growing vegetarian and vegan populations seeking plant-based alternatives to fish oil. The development of algae-based omega-3 products, which align with vegan lifestyles while providing similar or even superior health benefits as traditional fish oil, is set to play a critical role in this expansion.

Make confident decisions using our insights and analysis. Request a PDF Sample Report@ https://market.us/report/marine-omega-3-market/free-sample/

Key Takeaways

• The Global Marine Omega-3 Market is expected to be worth around USD 15.4 Billion by 2034, up from USD 9.2 Billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034.

• The Marine Omega-3 market shows significant growth in DHA, which constitutes 48.2% of consumption.

• Liquid forms of Omega-3 dominate, accounting for 45.2% of the overall market share.

• Supplements and functional foods represent 52.2% of the Marine Omega-3 market’s application segment.

• Supermarkets and hypermarkets lead the distribution channels, capturing 35.1% of the market share.

• In 2023, Asia-Pacific dominated the Marine Omega-3 Market with a 45.4% share, USD 3.9 Bn.

Key Market Segments

By Type

In 2023, the Marine Omega-3 Market exhibited a clear dominance in the "By Type" segment with Docosahexaenoic acid (DHA) leading at 48.2%. DHA, recognized for its vital role in cognitive health, is primarily sourced from fish oil, algae, and krill. Its high bioavailability makes it a popular ingredient in dietary supplements and functional foods, aligning with consumer preferences for products that support brain health and cognitive function. Eicosapentaenoic acid (EPA), capturing 31.7% of the market, is another major type of omega-3. Known for its anti-inflammatory properties, EPA is crucial for promoting cardiovascular health and reducing triglyceride levels. It is commonly derived from fish and algae and often paired with DHA in supplements to maximize health benefits, particularly for heart and joint health.

By Form

Liquid form led the Marine Omega-3 Market with a 45.2% share. Liquid omega-3 products are preferred for their high bioavailability and ease of incorporation into diets through functional foods and beverages. They offer versatility in dosage and are especially popular in dietary supplements and clinical nutrition. Powder form represented 34.1% of the market. This form provides ease of storage and longevity, making it ideal for incorporation into various food products like smoothies and snack bars. The powdered format is increasingly popular in dietary supplements, appealing to consumers looking for alternatives to liquid omega-3.

Softgel products accounted for 20.7% of the market share. Their popularity stems from the convenience of consumption and the ability to mask the strong taste of omega-3 oils, coupled with precise dosing capabilities. Softgels continue to be a preferred choice in the consumer market for marine-based omega-3 supplements.

By Application

Supplements and Functional Foods held a dominant share at 52.2%. This segment capitalizes on the increasing consumer demand for health and wellness products that prevent diseases and enhance overall health. It benefits from heightened awareness of the health benefits associated with omega-3, particularly in maintaining heart health and cognitive function. The Pharmaceuticals application constituted 29.5% of the market, driven by the therapeutic benefits of marine omega-3 in treating cardiovascular conditions, lowering triglycerides, and managing chronic diseases such as rheumatoid arthritis. The continued clinical research into additional therapeutic benefits of omega-3 is poised to further boost this sector.

By Distribution Channel

Infant Formula made up 11.8% of the market, underscored by the essential role of DHA and EPA in infant brain development. The trend towards omega-3-enriched infant formula is growing as more parents choose formula feeding, particularly in regions with lower rates of exclusive breastfeeding. Lastly, the Animal Feed and Pet Food segment represented 6.5% of the market. The inclusion of omega-3 fatty acids, especially EPA and DHA, in animal feed and pet food is expanding, aimed at improving the health and quality of livestock and pets. This segment is growing alongside the trend toward premium pet food products, reflecting an increased focus on health and nutrition in animal care.

Key Market Segments List

By Type

• Docosahexaenoic acid (DHA)

• Eicosapentaenoic acid (EPA)

• Alpha-linolenic acid (ALA)

• Docosapentaenoic acid (DPA)

• Others

By Form

• Liquid

• Powder

• Softgel

• Others

By Application

• Supplements and Functional Foods

• Pharmaceuticals

• Infant Formula

• Animal Feed and Pet Food

• Others

By Distribution Channel

• Supermarkets and Hypermarkets

• Pharmacies and Drug Stores

• Online Retailers

• Others

Emerging Trends

1. Sustainable and Plant-Based Sources: There's a growing consumer preference for sustainably sourced and plant-based omega-3s, driven by environmental concerns and dietary restrictions. Algae oil, in particular, is gaining popularity as a sustainable and vegan-friendly option, appealing to a broad consumer base looking for eco-friendly health products.

2. Advanced Bioavailability Formulations: Companies like EPAX are focusing on enhancing the bioavailability of omega-3 through innovative delivery systems. This trend is aimed at increasing the effectiveness of omega-3 absorption, catering to consumer demand for high-quality, highly effective nutritional supplements.

3. Functional Foods and Beverages: There is a significant trend towards incorporating omega-3 into functional foods and beverages. This movement caters to health-conscious consumers who prefer convenient nutrition solutions, leading to the development of omega-3 enriched dairy alternatives, baked goods, and beverages.

4. Focus on Aesthetic Benefits: Consumers are increasingly interested in the aesthetic benefits of omega-3, such as skin health and anti-aging effects. The market is seeing a rise in products that combine beauty and health benefits, indicating a shift towards holistic wellness.

5. Increased Application in Pet Foods: The use of marine omega-3 in pet food products is expanding. This trend reflects broader consumer interest in enhancing the health and well-being of pets, mirroring human dietary trends towards more functional and health-promoting ingredients.

Major Factors Driving the Growth of Marine Omega-3 Market

1. Health Benefits Awareness: The recognized health benefits of omega-3, such as reducing the risk of heart disease, combating inflammation, and supporting mental health, continue to drive consumer interest and market demand. Awareness of these benefits is increasing among consumers, leading to higher consumption of supplements, functional foods, and pharmaceuticals.

2. Technological Advancements in Bioavailability: Innovations that improve the absorption and effectiveness of omega-3 fatty acids are pivotal in market growth. Enhanced bioavailability ensures that consumers get more benefits from smaller doses, making omega-3 products more appealing.

3. Demand in the Pharmaceutical Sector: There's a significant rise in the use of omega-3 in the pharmaceutical industry due to its preventive and therapeutic properties. This is particularly notable in regions with high rates of cardiovascular diseases and where preventive healthcare is becoming a priority.

4. Growth in Personalized Nutrition: Advances in personalized health assessments and genetic testing are enabling the development of customized omega-3 supplements that cater to individual dietary needs and health conditions. This trend toward personalized nutrition is expected to further propel market growth.

5. Expansion in Emerging Markets: The marine omega-3 market is expanding rapidly in Asia-Pacific and other emerging regions due to rising disposable incomes, urbanization, and increasing health consciousness. These markets present new opportunities for growth through tailored products and localized marketing strategies.

6. Sustainable and Plant-Based Alternatives: The shift towards sustainable and ethically sourced omega-3, especially from algal oil, is attracting environmentally conscious consumers. This is also supported by the increasing vegan and vegetarian populations looking for plant-based health products.

Regulations On the Marine Omega-3 Market

1. FDA Labeling Regulations: The U.S. Food and Drug Administration (FDA) has set specific regulations for nutrient content claims of omega-3 fatty acids. For instance, terms like "high in" or "rich in" DHA (Docosahexaenoic Acid) and EPA (Eicosapentaenoic Acid) are prohibited on food labeling unless they meet certain criteria. There are also specific rules about claims related to ALA (Alpha-Linolenic Acid) that are based on a population-weighted approach.

2. Codex Alimentarius Standards: Internationally, the Codex Alimentarius has worked to establish a Nutrient Reference Value (NRV) for EPA and DHA, which is considered for general population labeling to reduce the risk of non-communicable diseases like heart disease. This is part of a global effort to standardize nutrient values and claims on food products.

3. Marine Microalgae as a Food Additive: Specific regulations are in place regarding the use of marine microalgae as a food additive, particularly as a source of omega-3s. For example, the additive must meet certain composition criteria and is restricted in how much can be used in animal feed to ensure safety and efficacy.

4. EU Regulations on Marine Omega-3: In the European Union, regulations are stringent regarding the extraction and marketing of omega-3 fatty acids, particularly those derived from fish oils. These regulations ensure sustainability and environmental protection, governing how omega-3 is extracted, processed, and sold in markets. The EU also sets strict contaminant levels to ensure product safety for consumers, focusing on heavy metals and other environmental pollutants.

5. Environmental Impact Assessments: Regulatory bodies also require comprehensive environmental impact assessments for the sourcing of marine ingredients, including omega-3 fatty acids. These assessments are crucial to ensuring that the extraction of omega-3 from marine sources does not adversely affect marine biodiversity or contribute to the overfishing of certain species. This is especially significant in areas where marine biodiversity is critical to ecosystem health.

To Get Moment Access, Buy Report Here: Enjoy Discounts of Up to 30%! https://market.us/purchase-report/?report_id=138056

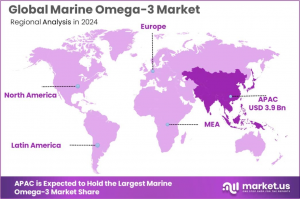

Regional Analysis

In 2023, the Marine Omega-3 Market experienced substantial regional diversification, with the Asia-Pacific region commanding the largest share. Capturing 45.4% of the global market, Asia-Pacific's dominance was underscored by a market valuation of USD 3.9 billion. This region's robust growth is attributed to several key factors including heightened health awareness among consumers, an expanding middle-class demographic, and an increasing focus on preventive healthcare and wellness. Notably, countries such as China, India, and Japan have experienced a surge in demand for omega-3 supplements, driving significant market expansion.

North America maintained a strong market presence, accounting for 30.2% of the global share. In this region, the United States and Canada are the primary contributors to market demand, where omega-3 fatty acids find extensive use across dietary supplements, functional foods, and pharmaceuticals. The rising consumer awareness regarding the benefits of omega-3 for cardiovascular and cognitive health has notably enhanced its market penetration and consumer base in North America.

Key Players Analysis

• Aker Biomarine Antarctic AS

• BASF SE

• BioProcess Algae, LLC

• Cargill, Inc.

• Croda International Plc

• Epax, Nuseed Global

• FMC Corporation

• GC Reiber Oils

• Koninklijke DSM N.V.

• Lonza

• LUHUA BIOMARINE (SHADONG) CO., LTD.

• Olvea Fish Oils

• Omega Protein Corporation

• Orkla Health

• Pharma Marine AS

• Polaris.

• Royal DSM

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release