Biofuel Consumption Surges Following Implementation of Canada’s Clean Fuel Regulations: Biofuels in Canada 2024 report

New report shows significant ramp up in adoption of low carbon fuels and cost-effective avoided emissions

The report’s highlights include:

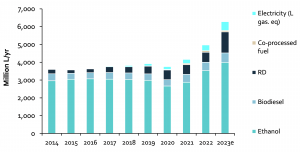

- Biofuel consumption surged in 2023, with renewable diesel (RD) more than doubling to 1.2 BL/yr, biodiesel consumption up 14% (530 ML/yr), and ethanol up 13% (4.0 BL/yr).

- Biofuel content in gasoline was 9.44%, and 6.23% in diesel (up 10% and 68% from 2022, respectively).

- In 2023, biofuels were responsible for 86% of Canada’s 2023 greenhouse gas emission reductions from all clean transportation fuel use, which totaled 11.4 million metric tonnes of climate change gases.

- In 2023, ethanol had 55% lower carbon emission than gasoline, and biomass-based diesel had 87% lower emissions than diesel.

- Electricity consumption by light-duty vehicles grew by 56% in 2023, on top of 41% growth in 2022.

- In 2023, biofuel blending lowered wholesale gasoline costs by $0.055/litre and raised wholesale diesel costs by $0.051/litre.

- Biofuel blended in gasoline (ethanol) reduced gasoline wholesale costs by almost $1B in 2023. Since 2010, ethanol has reduced wholesale gasoline costs by $10.4B.

- Biofuels blended with diesel fuel (renewable diesel and biodiesel) increased diesel wholesale costs by $1.5B in 2023. Since 2010, biofuel in diesel has increased wholesale diesel costs by $6.9B. (Greater use of lower cost biodiesel would have mitigated this premium.)

- Since 2010, biofuels use in Canada has reduced wholesale fuel costs by $3.4B. However, when biofuels are distributed at the retail level, over-taxation results in higher costs relative to gasoline and diesel.

- Taxing biofuel based on volume instead of energy content has the effect of overtaxing biofuels. Were biofuels taxed on energy delivered, biofuels would have saved consumers a total of $2.5 billion, rather than costing them $2.2 billion since 2010.

- Canadians spent $115.1B on gasoline and diesel fuels in 2023. Biofuels blending of 8.1% in gasoline and diesel (weighted average volumetric basis) in 2023 added 1.0% to overall fuel purchase costs. Had biofuels been taxed based on energy, costs would have increased 0.5%.

“After more than a decade of steady, modest growth in biofuels use, 2023 saw a 25% surge in demand for clean fuels” said Ian Thomson, ABFC President.

“The federal Clean Fuel Regulations (CFR) were a big driver, aided by a 28% increase in biofuels use under BC’s Low Carbon Fuel Standard and a 52% increase in Québec’s use due to the implementation of its new low carbon fuel regulation in 2023. In these regulations, biofuels are the most cost-effective way to reduce greenhouse gas emissions, reducing gasoline costs at the pump and modestly increasing a truck’s annual fuel bill.

“Notably, the greatest growth in biofuel use occurred in diesel-class vehicles. Notably, there was 21% reduction in the carbon intensity of these biofuels, highlighting the clean fuel sector's ability to apply innovations along the whole production value chain. Overall, the 2023 outcomes demonstrate how performance-based fuel regulations are effectively providing millions of Canadians with affordable, low-emission transportation.

“Fuel regulations are very efficient and flexible, and they create new jobs and value-add manufacturing across the supply chain – they are proving their mettle in the battle to find climate action solutions that are affordable and good for the Canadian economy.

“With the CFR now in effect, the report further clarifies the differences between a carbon tax and regulatory compliance credits. It highlights that “the fuel price impact of the CFR is over ten times smaller than that of a carbon tax with an equivalent dollar-per-tonne CO2 price.” This aligns with findings from the Canada West Foundation’s December 2020 analysis. “Biofuels are a highly cost-effective—and in some cases, even cost-negative—tool for reducing greenhouse gas emissions. For example, ethanol delivers a net benefit (savings) of -$116 per tonne, meaning it reduces both emissions and fuel costs. Most Canadians already use ethanol-blended fuels seamlessly in their daily lives, saving money and cutting climate emissions with every fill-up.”

The report also highlights the significance of over-taxation of biofuels in Canada. Fuel taxes are applied on a 'per litre' basis, disproportionately increasing the tax burden on lower-energy fuels, such as ethanol and biodiesel. This volumetric taxation—spanning excise, motor fuel, and carbon taxes—penalizes consumers for using low carbon biofuels. In 2023 alone, governments over-taxed Canadian consumers by $560 million due to volumetric rather than energy-based taxation. Since 2010, federal and provincial volume-based over-taxation of biofuels has added $4.7 billion to wholesale fuel costs, contributing to a net $2.2 billion cost for biofuel use over this period.

“Biofuels are already saving most Canadians money at the pump, but these savings could be even greater with fair taxation. Traditional transportation fuels have been taxed on a per-litre (volume) basis for decades but, with the growing use of biofuels and other low carbon alternatives, this approach needs to evolve,” said Ian Thomson. “The BIC 2024 report concluded that if taxes were charged on a ‘per unit of energy’ basis, biofuel consumption since 2010 would have saved consumers $2.5 billion.

“Advanced biofuels are fully compatible with the millions of internal combustion engine vehicles that will still be on Canadian roads by 2050. Low carbon, non-fossil, sustainable liquid fuels—whether biobased or derived from renewable synthetic platforms—are essential to cutting emissions in light-duty vehicles and particularly in trucking, aviation, marine, rail, and other hard-to-decarbonize sectors. Producing these fuels domestically will maximize the use of Canada’s energy infrastructure, while fostering a robust and innovative clean fuel economy.

“As Canada continues its transition to a low-carbon economy, advanced biofuels and fair policies are pivotal to achieving our climate goals while supporting economic growth. By adopting performance-based regulations, embracing innovation, offering fair taxation, and investing in sustainable fuel solutions, we can deliver meaningful savings to Canadians, reduce emissions across all sectors, and strengthen Canada’s position as a global leader in clean transportation fuels.”

The data in BIC reports are also visualized on ABFC’s Canadian Transportation Fuels Dashboard and Clean Fuels Report Card.

Ian Thomson

Advanced Biofuels Canada

+1 604-947-0040

ithomson@advancedbiofuels.ca

Visit us on social media:

X

LinkedIn

Distribution channels: Agriculture, Farming & Forestry Industry, Energy Industry, Environment, Politics, Waste Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release