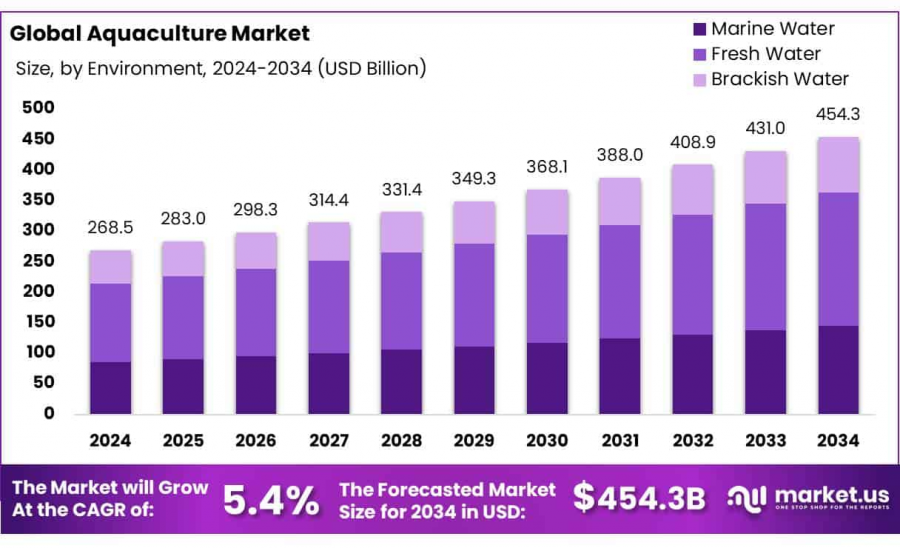

Aquaculture Market to Reach USD 454.3 Billion by 2034, Driven by a 5.4% CAGR Growth Trend

Aquaculture Market size is expected to be worth around USD 454.3 bn by 2034, from USD 268.5 bn in 2024, CAGR of 5.4% during the forecast period 2025 to 2034

NEW YORK, NY, UNITED STATES, January 24, 2025 /EINPresswire.com/ -- Report Overview

Aquaculture Market, also known as aquafarming, is the controlled cultivation of aquatic organisms such as fish, crustaceans, mollusks, and aquatic plants in freshwater and marine environments. It involves breeding, rearing, and harvesting under controlled conditions to enhance productivity and sustainability. Aquaculture serves as an alternative to wild fishing, helping to meet the rising global demand for seafood while reducing pressure on natural fish populations.

The aquaculture market encompasses the global industry involved in the farming, processing, and distribution of aquatic species for human consumption, pharmaceuticals, animal feed, and other industrial applications. The market is driven by increasing seafood consumption, advancements in aquaculture technology, and the need for sustainable food production. It includes various segments based on species, environment (marine, freshwater, brackish), and farming techniques.

Growth of the aquaculture market is driven by increasing global seafood consumption, as fish is a key protein source in many diets. Population growth, urbanization, and rising disposable incomes in developing countries further fuel demand. Additionally, advancements in aquaculture technology, such as automated feeding systems, biofloc technology, and genetic improvements, enhance productivity and sustainability, supporting market expansion.

Rising health awareness and the nutritional benefits of seafood, including its high protein, omega-3 fatty acid, and essential mineral content, are major demand drivers. Additionally, the depletion of wild fish stocks due to overfishing has pushed consumers and industries toward farmed seafood. Government initiatives and subsidies promoting aquaculture as a sustainable food production method also contribute to market demand.

Opportunities in the aquaculture market include the adoption of sustainable and eco-friendly farming practices, such as recirculating aquaculture systems (RAS) and integrated multi-trophic aquaculture (IMTA). The growing interest in plant-based and alternative fish feeds also presents investment potential. Additionally, expanding market penetration in emerging economies with high seafood demand offers lucrative growth prospects.

Get a Sample PDF Report: https://market.us/report/aquaculture-market/request-sample/

Key Takeaway

• Aquaculture Market size is expected to be worth around USD 454.3 billion by 2034, from USD 268.5 billion in 2024, growing at a CAGR of 5.4%.

• Fresh Water held a dominant market position in the aquaculture market, capturing more than a 48.60% share.

• Aquatic Animals held a dominant market position in the aquaculture market, capturing more than an 81.30% share.

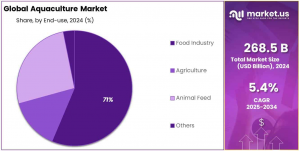

• Food Industry held a dominant market position in the aquaculture sector, capturing more than a 71.20% share.

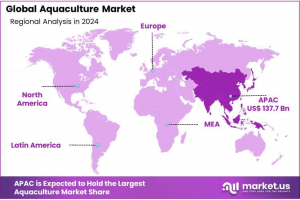

• Asia Pacific region is poised to emerge as a leading market for aquaculture, capturing the largest market share of 51.30%. It is anticipated to reach a value of 137.07 Bn

Aquaculture Market Segment Analysis

By Environment Analysis

In 2024, Fresh Water aquaculture led the market with a 48.60% share, thriving on low costs and ample inland waters, primarily raising carp, trout, and tilapia. Marine Water, or mariculture, focuses on high-value species like salmon and shrimp in natural sea environments, benefiting from premium prices and technological advances. Brackish Water aquaculture, merging freshwater and marine techniques, grew in popularity for farming species like barramundi in transitional water zones, appealing to health-conscious consumers.

By Species Analysis

In 2024, Aquatic Animals dominated the aquaculture market with an 81.30% share, driven by high demand for protein-rich diets, including fish, crustaceans, and mollusks. Enhancements in breeding, disease control, and farming techniques boosted their productivity and sustainability. Conversely, Aquatic Plants like seaweeds and microalgae, while smaller in scale, are growing in popularity due to their health and environmental benefits, finding uses in pharmaceuticals, cosmetics, and biofuels, spurred by biotechnological innovations.

By End-User Analysis

In 2024, The Food Industry led the aquaculture sector with a 71.20% share, driven by rising global seafood demand for its protein benefits and sustainability over traditional fishing. The Agriculture segment, though smaller, is expanding with aquaponics, fostering organic crop production and water conservation. The Animal Feed segment utilizes fish by-products for high-protein feed, enhancing livestock nutrition with fishmeal and omega-3-rich fish oil, supporting overall industry sustainability.

Buy Now: https://market.us/purchase-report/?report_id=21041

Key Market Segments

By Environment

• Marine Water

• Fresh Water

• Brackish Water

By Species

• Aquatic Plants

— Seaweed

— Microalgae

• Aquatic Animals

— Fish

— Crustaceans

— Mollusks

— Others

By End-use

• Food Industry

• Agriculture

• Animal Feed

• Others

Top Emerging Trends

1. Rise of Land-Based Aquaculture: Land-based aquaculture, particularly recirculating aquaculture systems (RAS), is gaining traction due to sustainability and biosecurity benefits. These systems allow fish farming in controlled environments, reducing disease risks and environmental impact. Governments and investors are increasingly supporting RAS due to its ability to reduce overfishing and improve food security. With advancements in filtration, water recycling, and automation, RAS technology is becoming more cost-effective, making it a viable alternative to traditional open-water aquaculture. This trend will likely reshape the future of fish farming.

2. Growth in Alternative Feeds: Traditional fish feed, primarily fishmeal and fish oil, is becoming expensive and unsustainable. The industry is shifting toward plant-based, insect-based, and microbial proteins to reduce reliance on wild-caught fish for feed. Companies are also exploring single-cell proteins and algae-based feeds to improve fish nutrition while lowering the environmental footprint. These innovations help improve sustainability, lower costs, and meet rising global seafood demand. Governments and regulatory bodies are supporting research and development in alternative feed solutions, driving further growth.

3. Adoption of Smart Aquaculture Technology: Aquaculture is becoming more tech-driven, with AI, IoT, and automation improving efficiency. Smart sensors now monitor water quality, oxygen levels, and fish health in real-time, reducing risks and losses. AI-powered feeding systems optimize feed usage, lowering costs and improving fish growth. Blockchain is also gaining attention for traceability, ensuring sustainable and transparent supply chains. These innovations make aquaculture more scalable and profitable while addressing environmental concerns. Smart technologies will play a major role in the industry's future.

4. Expansion of Offshore Aquaculture: With coastal areas becoming crowded, offshore aquaculture is emerging as a sustainable solution. Deep-sea fish farming reduces environmental impact by using strong ocean currents to disperse waste naturally. Large floating cages and submersible systems allow farming in deeper waters, improving fish health and growth rates. Governments are increasingly supporting offshore projects through policies and investments. While initial costs are high, technological advancements in automation and cage design are making offshore aquaculture more feasible. This shift could help meet the growing demand for seafood.

5. Focus on Sustainable Certification: Consumers are becoming more aware of sustainable seafood, pushing companies to adopt eco-friendly practices. Certifications like ASC (Aquaculture Stewardship Council) and Best Aquaculture Practices (BAP) are gaining importance, ensuring responsible farming methods. Retailers and food service companies now prioritize suppliers with these certifications, influencing farming practices globally. Sustainable certifications not only help with market access but also improve brand reputation. As regulatory bodies tighten environmental standards, more aquaculture firms are expected to adopt certified sustainable practices, shaping the industry’s long-term growth.

Regulations on Aquaculture Market

The aquaculture industry operates under strict regulations to ensure environmental sustainability, food safety, and ethical farming. These regulations vary by region but typically cover water quality management, species selection, feed standards, and disease control.

Governments and international organizations, such as the Food and Agriculture Organization (FAO) and the World Aquaculture Society, establish guidelines to mitigate ecological impacts and promote responsible farming. Environmental policies focus on preventing habitat destruction, water pollution, and the spread of invasive species.

Many countries require licensing and environmental impact assessments before approving aquaculture projects. Additionally, restrictions on antibiotic use and feed composition help ensure food safety and minimize contamination risks.

Trade regulations play a crucial role in maintaining product integrity. Certifications such as Best Aquaculture Practices (BAP) and Aquaculture Stewardship Council (ASC) ensure traceability and compliance with international standards. Labeling requirements further enhance transparency in global seafood markets. Ethical labor laws also regulate employment practices within the industry.

As global seafood demand rises, governments continuously refine policies to balance industry growth with sustainability. Adapting to evolving regulations is essential for aquaculture operators to maintain market access, consumer trust, and industry credibility.

Regional Analysis

Asia-Pacific leads the global aquaculture market, accounting for 51.30% of the market share, valued at USD 137.7 billion. This dominance is driven by countries like China and India, where aquaculture is integral to food security and economic development. The region's favorable climatic conditions, extensive coastlines, and advancements in aquaculture technologies contribute to its leading position.

In North America, the aquaculture market is experiencing steady growth, propelled by rising demand for sustainable seafood and decreasing wild fish stocks. The United States and Canada are key contributors, focusing on species such as salmon and shellfish. Government initiatives promoting sustainable practices and technological innovations in farming methods are further supporting market expansion.

Europe's aquaculture industry is well-established, with countries like Norway and Scotland leading in salmon production, representing more than 30% of regional output. The region emphasizes high standards for sustainability and product quality, catering to a health-conscious consumer base. Additionally, investments in research and development are fostering advancements in aquaculture practices across Europe.

The Middle East and Africa are witnessing gradual growth in aquaculture, driven by increasing seafood consumption and efforts to reduce dependence on imports. Countries such as Egypt and Nigeria are investing in aquaculture to enhance food security and create employment opportunities. Challenges like water scarcity and limited infrastructure are being addressed through innovative farming techniques and international collaborations.

Latin America's aquaculture sector is expanding, with nations like Brazil, Chile, and Ecuador playing significant roles. Chile, for instance, is a major producer of farmed salmon, contributing substantially to the global supply. The region's favorable environmental conditions and government support for aquaculture initiatives are key factors driving market growth.

Key Players Analysis

◘ Mowi ASA

◘ SalMar

◘ Leroy Seafood Group

◘ Bakkafrost Scotland

◘ Cermaq Group AS

◘ Grieg Seafood

◘ Cooke Aquaculture Inc.

◘ Blue Ridge Aquaculture , Inc.

◘ Eastern Fish Company

◘ Huon Aquaculture Group Pty Ltd.

◘ asmak

◘ Nireus Aquaculture S.A

◘ Promarisco

◘ Thai Union Group Plc

◘ Leroy Seafood Group ASA

◘ Other Key Players

Recent Developments Aquaculture Market

— In August 2024, Norway's salmon farming industry faced significant challenges due to an unusually harsh winter combined with the El Niño climate phenomenon, resulting in a record fish mortality rate of 16.7%. This situation prompted companies to innovate with underwater cages and extended land-based rearing to protect salmon.

— In June 2024, Huon Aquaculture announced a significant investment of USD 110 million to expand its freshwater Atlantic salmon nursery facility at Whale Point in Port Huon, aiming to increase production capacity.

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Agriculture, Farming & Forestry Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release